In the realm of business transactions and asset acquisitions, one key concept that often plays a crucial role is ‘goodwill.’ When a company is purchased for a price that exceeds the fair market value of its identifiable assets, the difference between the purchase price and the fair market value is often attributed to ‘goodwill.’ This intangible asset represents the value of the company’s reputation, customer relationships, brand recognition, and other non-physical attributes that contribute to its overall success.

Understanding ‘goodwill’ and the intricacies surrounding its valuation, as well as the issuance of ‘goodwill receipt,’ is essential for investors, business owners, and those involved in financial transactions. In this article, we will delve into the world of ‘goodwill receipt,’ shedding light on its significance and unraveling the complexities that surround this important aspect of business acquisitions.

Understanding Goodwill Receipts: A Comprehensive Guide

What is a Goodwill Receipt?

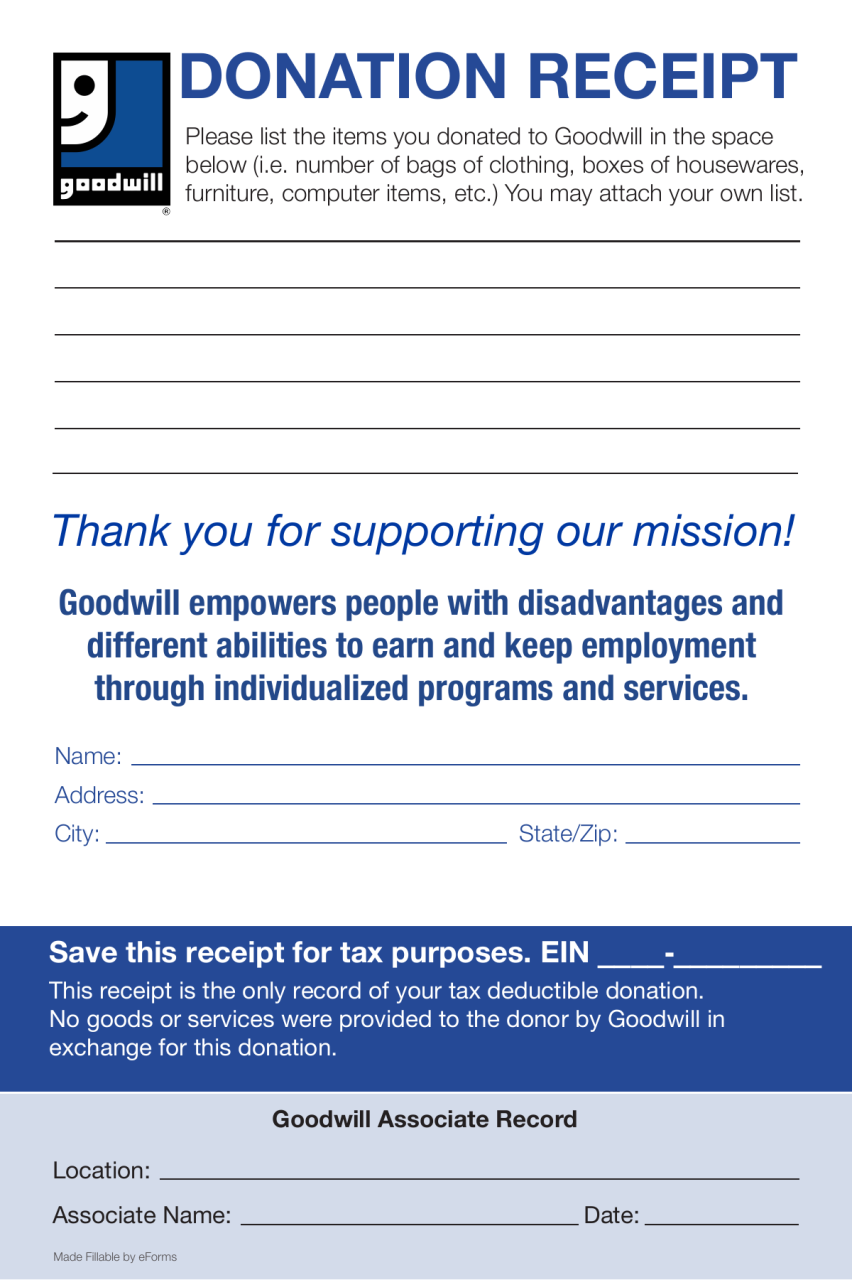

A goodwill receipt is a document issued by a charity or non-profit organization to acknowledge the receipt of a donation from an individual, business, or corporation. It serves as a record of the donation for tax purposes and provides the donor with a receipt for their contribution.

Goodwill receipts are often provided for donations of items such as used clothing, household goods, furniture, and vehicles. They may also be issued for monetary donations, such as cash, checks, or online payments.

The Importance of Goodwill Receipts

Goodwill receipts play a crucial role in the tax deduction process. They provide donors with proof of their donation, which they can use to claim a charitable deduction on their tax returns. Without a valid receipt, taxpayers may not be able to deduct the full amount of their donation.

In addition to their tax benefits, goodwill receipts help charities track their donations and demonstrate their accountability to donors. They provide a transparent record of the organization’s operations and help ensure that donations are being used for their intended purposes.

What Information is Included on a Goodwill Receipt?

Goodwill receipts typically include the following information:

- Name and address of the charitable organization

- Date of the donation

- Description of the donated item(s) or the amount of the monetary donation

- Valuation of the donated item(s) or a statement that the donation was in kind

- Signature of an authorized representative of the charitable organization

How to Get a Goodwill Receipt

Individuals, businesses, and corporations can typically obtain a goodwill receipt by following these steps:

- Make a donation to the charity or non-profit organization of their choice.

- Request a goodwill receipt from the organization’s representative.

- Review the receipt carefully to ensure that all information is correct.

- Keep the receipt for tax purposes and as a record of the donation.

Tax Implications of Goodwill Receipts

Deductibility of Goodwill Donations

Charitable donations, including those made to goodwill organizations, are generally tax-deductible for both individuals and businesses. However, there are certain limitations to the amount that can be deducted, depending on the type of donation and the taxpayer’s income.

For individuals, cash donations to qualified charities are deductible up to 50% of their adjusted gross income (AGI). Non-cash donations, such as used clothing or household goods, are deductible up to the fair market value of the items donated, subject to certain limitations.

Substantiation Requirements

To claim a charitable deduction, taxpayers must have a record of the donation, such as a goodwill receipt. The receipt must provide certain information, including the name and address of the charity, the date of the donation, and a description of the donated property or the amount of the cash donation.

In the case of non-cash donations, taxpayers may also need to provide an appraisal from a qualified appraiser to establish the fair market value of the items donated.

Accounting for Goodwill Receipts

Recording Goodwill Donations

When a business makes a donation to a goodwill organization, it should record the transaction as a charitable expense. The expense is recognized in the period in which the donation is made.

For businesses that donate significant amounts of goods or services to charities, it may be beneficial to establish a goodwill policy to guide the organization’s charitable giving activities.

Impact on Financial Statements

Charitable donations can impact a business’s financial statements in several ways. They reduce the business’s taxable income, which can lead to lower income tax expenses.

In addition, charitable donations can improve a business’s reputation and public image, which can have a positive impact on sales and other metrics.

Verifying Goodwill Receipts for Tax Purposes

Authenticity and Credibility

Taxpayers should be mindful of the authenticity and credibility of goodwill receipts before claiming deductions. Ensure that the organization is a legitimate non-profit or charitable entity recognized by the Internal Revenue Service (IRS) or relevant tax authorities.

Verify the organization’s name, address, and any other identifying information provided on the receipt against official sources or databases.

Reasonableness of Valuation

For non-cash donations, it’s important to assess the reasonableness of the valuation provided on the goodwill receipt. If the valuation seems excessive or unrealistic, the IRS may scrutinize the deduction.

Consider obtaining an appraisal from an independent appraiser to substantiate the fair market value of the donated items.

Consequences of Misusing Goodwill Receipts

Civil Penalties

Intentionally overstating the value of donated items or claiming deductions for non-existent donations can result in civil penalties from the IRS.

Taxpayers may face fines, interest charges, and loss of deductions for improperly claimed charitable contributions.

Criminal Prosecutions

In severe cases, such as fraudulent use of goodwill receipts for substantial amounts or organized schemes, criminal charges may be filed.

Individuals or organizations involved in such activities could face imprisonment or other legal consequences.

Due Diligence for Businesses and Organizations

Ethical Considerations

Businesses and organizations should adhere to ethical practices and ensure that goodwill donations are made to legitimate charities and for legitimate purposes.

Avoid using goodwill receipts as a means of personal gain or to disguise taxable income.

Internal Controls

Establish internal controls to prevent misuse of goodwill receipts within the organization. Implement procedures for verifying the authenticity of receipts and reviewing the reasonableness of valuations.

Regularly monitor and audit charitable giving activities to ensure compliance with tax laws and ethical standards.

Living Happy

Living Happy