In the ever-evolving digital landscape, crypto platforms have emerged as transformative forces, seamlessly bridging the worlds of finance and technology. These platforms empower individuals and institutions to navigate the complexities of cryptocurrencies, providing access to a realm of decentralized finance and limitless possibilities.

However, the realm of crypto platforms is not without its challenges. Security concerns, fluctuating market conditions, and regulatory complexities often cast a shadow over the industry’s potential. As we delve into this article, we will explore the intricacies of crypto platforms, unravel their significance, and shed light on the opportunities and challenges that shape their trajectory.

Join us on this journey as we decipher the intricacies of this rapidly evolving landscape, unlocking its secrets and empowering you to make informed decisions about your crypto endeavors.

Cryptocurrency Platforms: A Comprehensive Overview

What are Cryptocurrency Platforms?

Cryptocurrency platforms are online marketplaces that facilitate the buying, selling, and trading of digital assets such as Bitcoin, Ethereum, and Litecoin. These platforms provide a secure and user-friendly interface for individuals and institutions to access the crypto market.

Cryptocurrency platforms offer a range of services, including:

- Spot trading: Enables users to buy and sell cryptocurrencies at current market prices.

- Derivatives trading: Allows users to trade futures, options, and other financial instruments based on cryptocurrencies.

- Staking: Facilitates the earning of rewards by holding and validating specific cryptocurrencies.

- Custody services: Provides secure storage solutions for users’ crypto assets.

- Fiat currency gateways: Facilitates the conversion of cryptocurrencies to fiat currencies and vice versa.

Choosing the Right Cryptocurrency Platform

Selecting the right cryptocurrency platform is crucial for a smooth and secure trading experience. Here are key factors to consider:

- Security: Ensure the platform implements robust security measures to protect user funds.

- Fees: Compare the trading fees, withdrawal fees, and other charges levied by different platforms.

- Currency Selection: Consider the availability of the cryptocurrencies you’re interested in trading.

- Trading Volume: Opt for platforms with a high trading volume to ensure liquidity and minimize slippage.

- Customer Support: Evaluate the responsiveness and availability of customer support in case of any issues.

Types of Cryptocurrency Platforms

Cryptocurrency platforms can be broadly classified into two types:

- Centralized Exchanges: Operated by a central entity, these platforms hold user funds and provide a user-friendly interface.

- Decentralized Exchanges: Peer-to-peer marketplaces where users interact directly without intermediaries.

Advantages of Cryptocurrency Platforms

Cryptocurrency platforms offer several advantages over traditional financial institutions:

- Accessibility: Available 24/7, allowing users to trade cryptocurrencies anytime, anywhere.

- Transparency: Blockchain technology ensures the transparency and immutability of transactions.

- Global Reach: Facilitates trading with individuals and institutions worldwide.

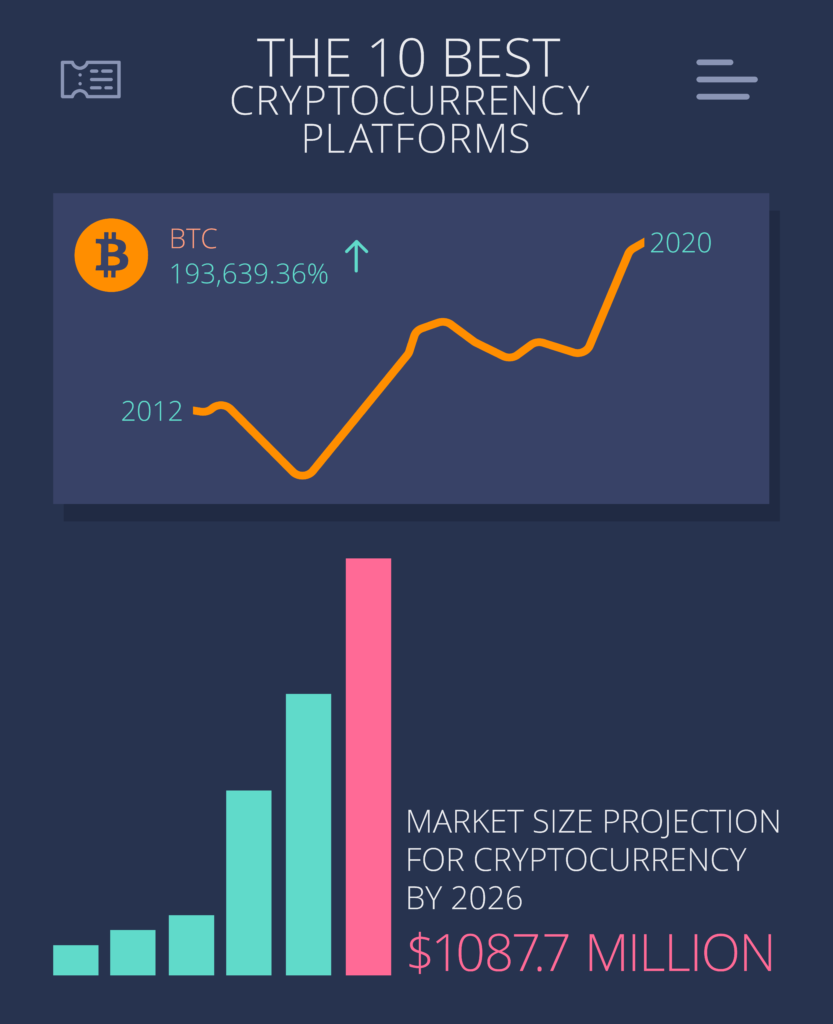

- Investment Opportunities: Provide access to a growing asset class with the potential for significant returns.

Conclusion

Cryptocurrency platforms are essential gateways to the digital asset market. By carefully choosing a platform that meets their needs, individuals and institutions can safely and efficiently buy, sell, and trade cryptocurrencies.

Security Considerations for Crypto Platforms

Importance of Security Measures

In the realm of crypto platforms, security is paramount. These platforms hold and facilitate transactions involving valuable digital assets, making them alluring targets for hackers and malicious actors.

Robust security measures are vital to safeguarding user funds and maintaining the integrity of the platform. Implementing industry-leading practices protects against unauthorized access, fraud, and other threats.

Common Security Features and Protocols

Crypto platforms employ a range of security features to mitigate risks, including:

- Two-factor authentication (2FA)

- Multi-signature wallets

- Cold storage solutions

- Regular security audits

- Encryption of sensitive data

These protocols enhance platform security, reduce vulnerabilities, and foster trust among users.

Regulatory Landscape of Crypto Platforms

Regulatory Evolution and its Impact

The regulatory environment surrounding crypto platforms is evolving rapidly to keep pace with the dynamic nature of the industry. Governments worldwide are grappling with the challenge of balancing innovation and investor protection.

Emerging regulations aim to establish clear guidelines for platform operations, protect users from fraud and abuse, and ensure compliance with anti-money laundering and know-your-customer (KYC) requirements.

Compliance and its Benefits

Compliant platforms are perceived as more trustworthy and reliable, attracting a wider user base. Adhering to regulatory frameworks enhances platform credibility and fosters stability within the crypto ecosystem.

Compliance also reduces legal risks and provides a solid foundation for future growth as the regulatory landscape matures.

Emerging Trends in Crypto Platforms

Decentralized Finance (DeFi) Integration

DeFi applications are transforming the crypto landscape by offering decentralized alternatives to traditional financial services. Crypto platforms are integrating DeFi protocols to provide users with access to yield farming, lending, borrowing, and other financial services.

This convergence of CeFi (centralized finance) and DeFi creates a more robust and inclusive financial ecosystem.

Metaverse and Crypto Integration

The metaverse, a virtual realm where people interact and engage in various activities, is rapidly gaining traction. Crypto platforms are bridging the gap between the physical and virtual worlds by enabling users to purchase and trade digital assets within the metaverse.

This integration opens up new opportunities for creators, businesses, and investors in the metaverse economy.

Advanced Trading Features on Crypto Platforms

Margin Trading

Margin trading allows users to leverage borrowed funds to magnify potential profits. However, this comes with increased risk as losses are also amplified.

Platforms offer flexible leverage options, enabling traders to customize their risk exposure.

Futures and Options Trading

Crypto platforms provide access to derivatives like futures and options. These instruments enable traders to speculate on future price movements or hedge against risks.

Futures and options offer advanced trading strategies and the potential for significant returns.

Customer Support and Education

Comprehensive Support Options

Top-notch customer support is crucial for a seamless trading experience. Crypto platforms offer various support channels, including:

- Live chat

- Email support

- Phone support

- FAQs and knowledge base

Educational Resources

Platforms recognize the need for user education. They provide in-depth guides, tutorials, webinars, and other resources to empower traders with knowledge.

Education empowers users to make informed decisions and avoid common pitfalls in the crypto market.

Investment Strategies on Crypto Platforms

Buy-and-Hold Strategy

Buy-and-hold involves purchasing and holding cryptocurrencies for the long term, aiming for capital appreciation.

This strategy favors investors with a high risk tolerance and a long-term investment horizon.

Day Trading

Day traders capitalize on short-term price fluctuations by buying and selling cryptocurrencies within a single trading session.

Day trading requires significant market knowledge, risk management skills, and a high degree of liquidity.

Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of funds at regular intervals, regardless of market conditions.

This strategy reduces market timing risks and can help accumulate cryptocurrencies gradually.

Living Happy

Living Happy