Have you ever wondered how you can make a lasting impact on the causes you care about, even after you’re gone? Benevity donations offer a unique opportunity to do just that. By incorporating charitable giving into your estate planning, you can ensure that your legacy extends beyond your lifetime.

In this article, we will delve into the world of benevity donations, exploring their significance, advantages, and the common challenges associated with this philanthropic approach. Whether you’re an experienced donor or just beginning your charitable journey, this comprehensive guide will provide valuable insights into the power of planned giving and empower you to make a meaningful difference through benevity donations.

Benevity Donations: Enhancing Employee Engagement and Corporate Social Impact

Benevity Donations: An Overview

Benevity is a leading provider of corporate social responsibility (CSR) software solutions that empower companies and their employees to make a positive impact on the world. Benevity Donations is a key component of these solutions, enabling employees to easily donate to their favorite charities through a user-friendly platform.

Through Benevity Donations, companies can create and manage employee donation programs that align with their values and strategic goals. This fosters a culture of giving and social responsibility within the organization, driving employee engagement and overall well-being.

Benefits of Benevity Donations for Employees

Benevity Donations provides numerous benefits for employees, enhancing their satisfaction and fostering a sense of purpose within the workplace.

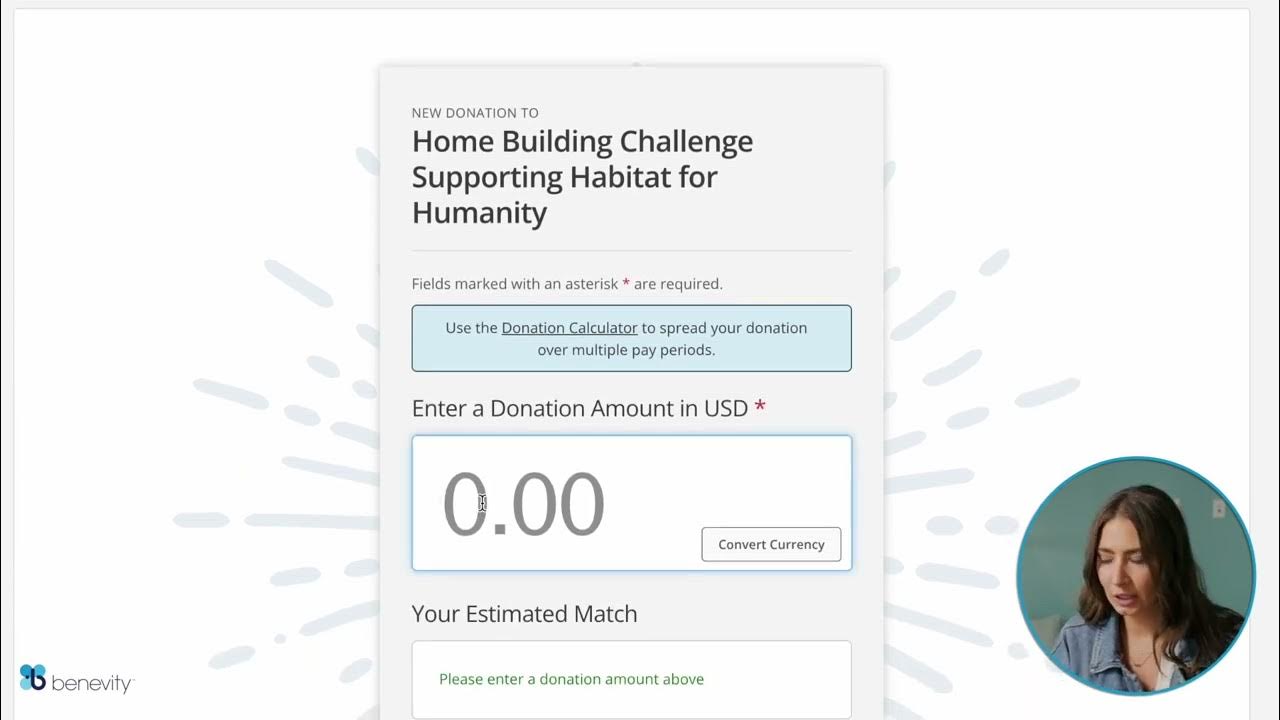

- Simplified Donation Process: Employees can conveniently donate to their preferred charities through an intuitive platform, streamlining the donation process and reducing administrative burden.

- Matching Donations: Many companies offer matching gift programs, doubling or even tripling the impact of employee donations, encouraging higher levels of giving and engagement.

- Employee Recognition: Companies can recognize employees for their charitable contributions, fostering a culture of appreciation and gratitude.

Benefits of Benevity Donations for Companies

Benevity Donations offers significant advantages for companies, strengthening their brand reputation and driving positive social change.

- Enhanced Employee Engagement: By creating a culture of giving, Benevity Donations increases employee satisfaction and loyalty, leading to higher productivity and reduced turnover.

- Improved Corporate Reputation: Companies that demonstrate a commitment to social responsibility through Benevity Donations enhance their brand image and attract consumers and partners who share their values.

- Tax Benefits: Employee donations made through Benevity Donations qualify for tax deductions, providing financial incentives for companies to support charitable giving.

How Benevity Donations Works

Benevity Donations operates on a user-friendly platform that streamlines the donation process for employees and administrators alike.

Employee Experience: Employees can access Benevity Donations through a dedicated portal, where they can browse a searchable database of charities, create giving plans, and track their donations online.

Company Administration: Company administrators can customize the Benevity Donations platform to align with their CSR goals, set up matching gift programs, and generate reports to measure the impact of their employee giving programs.

Conclusion

Benevity Donations empowers companies and employees to make a meaningful impact on the world through strategic and impactful giving. By fostering employee engagement, enhancing corporate reputation, and driving positive social change, Benevity Donations is a powerful tool for organizations committed to social responsibility and sustainable growth.

Tax Considerations and Benevity Donations

Tax Benefits for Donors

Benevity Donations offers tax benefits to employees who make charitable contributions through the platform. Donations are eligible for tax deductions, allowing donors to reduce their taxable income and potentially save on taxes.

The amount of tax savings depends on the donor’s income, tax bracket, and the amount of their donation. It’s important to consult with a tax professional to determine the specific tax implications of Benevity Donations.

Charitable Deductions for Companies

Companies that establish matching gift programs through Benevity Donations may be eligible for corporate tax deductions. Matching gifts are considered charitable contributions and can be deducted from the company’s taxable income.

The deductibility of matching gifts is subject to certain limitations and restrictions. Companies should consult with a tax advisor to ensure compliance with all applicable tax laws.

Ethical Considerations in Benevity Donations

Transparency and Accountability

Ethical considerations play a crucial role in Benevity Donations. Companies and employees should prioritize transparency and accountability in all aspects of their giving programs.

It’s important to disclose any potential conflicts of interest or biases when selecting charities or allocating funds. Regular reporting and audits can ensure the ethical and responsible use of donated funds.

Avoiding Coercion and Influence

Benevity Donations should be voluntary and free from any form of coercion or undue influence. Employees should not feel pressured or obligated to donate through the platform.

Companies should create clear policies that prohibit any retaliation or discrimination based on employees’ giving decisions.

Expanding Benevity Donations: Innovation and Growth

Technology Advancements

Benevity Donations continues to evolve through technological advancements. Artificial intelligence (AI) and machine learning (ML) are being integrated to enhance the user experience and automate tasks.

These technologies can provide personalized recommendations, streamline donation processing, and monitor the impact of giving programs more effectively.

Impact Measurement and Reporting

Measuring the impact of Benevity Donations is crucial for evaluating its effectiveness and demonstrating its value to stakeholders.

Companies should establish clear metrics and reporting mechanisms to track the social, environmental, and economic impact of their charitable giving. This information can inform future decision-making and demonstrate the transformative power of Benevity Donations.

Corporate Social Impact through Benevity Donations

Empowering Employees

Benevity Donations empowers employees to make a tangible difference by providing them with a convenient and engaging platform to support the causes they care about.

By fostering a culture of giving, companies can cultivate a sense of purpose and ownership among employees, leading to increased employee morale and commitment.

Driving Social Change

Benevity Donations enables companies to amplify their social impact by leveraging the collective power of their employees’ giving.

By aggregating individual donations and directing them towards strategic initiatives, companies can contribute to meaningful social change and support communities in need.

Challenges and Considerations in Benevity Donations

Potential Pitfalls

Benevity Donations is not without its challenges. It’s crucial to address potential pitfalls to ensure the effectiveness and integrity of donation programs.

These challenges may include administrative complexities, ensuring compliance with tax regulations, and managing potential conflicts of interest.

Overcoming Obstacles

To overcome these challenges, companies should develop clear policies and procedures, seek professional guidance from experts, and foster a culture of transparency and accountability.

By proactively addressing potential pitfalls, organizations can maximize the impact of their Benevity Donations programs and mitigate risks.

Role of Technology in Benevity Donations

Data-Driven Insights

Technology plays a vital role in enhancing Benevity Donations. Data analytics can provide valuable insights into donation patterns, donor engagement, and the impact of giving programs.

By harnessing data, companies can tailor their programs, identify areas for improvement, and demonstrate the tangible results of their charitable efforts.

Personalized Experiences

Technology can also enhance the donor experience by providing personalized recommendations, streamlining donation processes, and enabling donors to track the impact of their giving in real-time.

By leveraging technology to create seamless and engaging experiences, Benevity Donations can foster a deeper connection between donors and the causes they support.

Conclusion

Benevity Donations is a powerful tool for companies and employees to create a lasting impact through strategic and impactful giving. By embracing the principles of transparency, accountability, and innovation, organizations can unlock the full potential of Benevity Donations and drive meaningful social change while fostering employee engagement and enhancing their corporate reputation.

Living Happy

Living Happy