In the enigmatic world of digital finance, crypto brokers play a pivotal role, bridging the gap between investors and the volatile crypto markets. These intermediaries provide access to a vast array of crypto assets, facilitating trades and enabling individuals to tap into the potential rewards of blockchain technology.

Yet, amidst the allure and complexity of crypto trading, numerous challenges arise, leaving investors seeking guidance and expertise.

This in-depth article delves into the intricate universe of crypto brokers, empowering readers to navigate the risks and rewards associated with these intermediaries. By shedding light on the essential functionalities, regulatory frameworks, and common pitfalls, we aim to equip investors with the knowledge and confidence to make informed decisions in the ever-evolving crypto landscape.

Crypto Brokers: Your Ultimate Guide to Navigating the Crypto Market

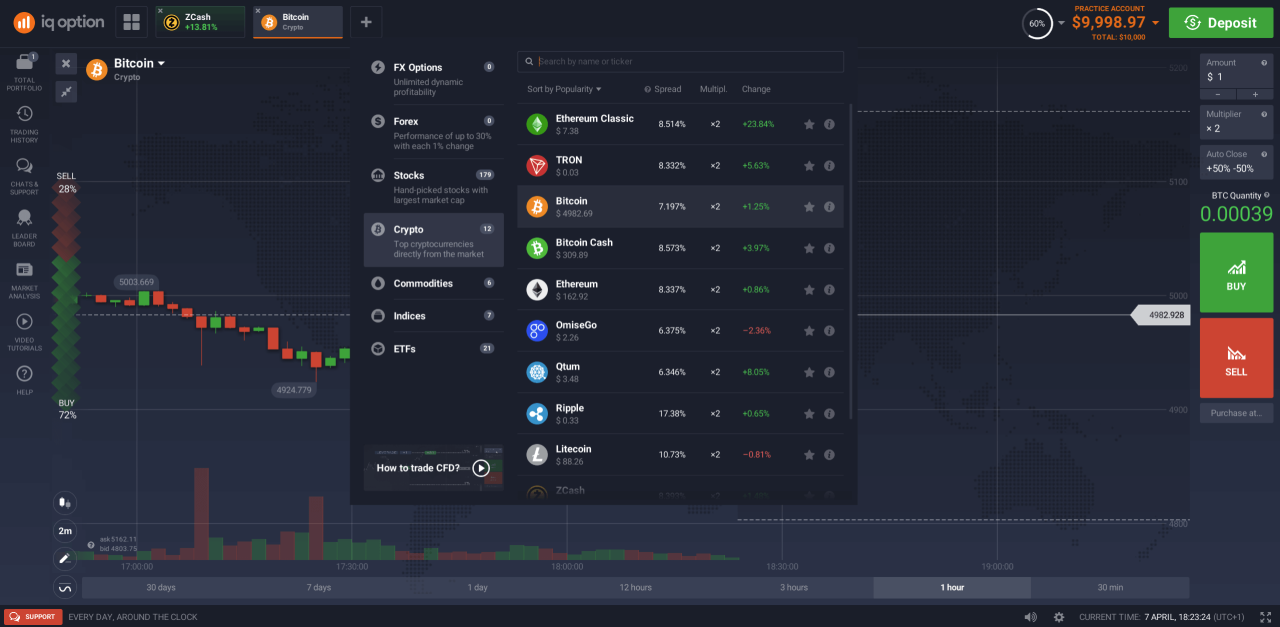

In the realm of digital assets, crypto brokers stand as the gatekeepers to the vast expanse of the cryptocurrency market. These intermediaries serve as a bridge between investors and crypto exchanges, providing a user-friendly platform for buying, selling, and trading cryptocurrencies.

As the crypto industry continues to explode, selecting the right broker becomes paramount. This comprehensive guide will delve into the intricacies of crypto brokers, empowering you with the knowledge and insights to make an informed choice that aligns with your investment objectives.

Types of Crypto Brokers

Crypto brokers offer a range of services and cater to diverse investor needs. Here are the main types:

Centralized Brokers: These brokers operate as centralized entities, holding custody of your funds and facilitating trades on their own platforms. They typically offer a wider selection of cryptocurrencies and features but may charge higher fees.

Decentralized Brokers: Unlike centralized brokers, decentralized brokers leverage blockchain technology to facilitate peer-to-peer transactions. They provide greater transparency and security but may have limited cryptocurrency offerings and advanced functionality.

Factors to Consider When Choosing a Crypto Broker

When selecting a crypto broker, several key factors warrant consideration:

Fees: Compare the trading fees, deposit fees, and withdrawal fees charged by different brokers. These fees can significantly impact your profitability.

Security: Assess the security measures implemented by the broker, such as two-factor authentication, cold storage, and insurance coverage. Trustworthy brokers prioritize the safety of your funds.

Regulation: Determine whether the broker is regulated by reputable authorities. Regulation ensures compliance with industry standards and protects your interests as an investor.

Customer Support: Excellent customer support is invaluable, especially when navigating complex crypto transactions. Choose a broker that provides responsive and knowledgeable support.

Benefits of Using a Crypto Broker

Crypto brokers offer numerous benefits, including:

Convenience: Brokers make it easy to buy, sell, and trade cryptocurrencies without the need for technical expertise or direct interaction with exchanges.

Security: Reputable brokers employ robust security measures to safeguard your funds, protecting them from hacking and fraud.

Variety: Brokers typically offer a wide range of cryptocurrencies, enabling you to diversify your portfolio and explore different investment opportunities.

Research and Analysis: Many brokers provide valuable research and analysis tools to help you make informed trading decisions.

Crypto Brokerage Fees

Crypto brokers charge various fees for their services, including trading fees, deposit fees, withdrawal fees, and spread fees. Understanding these fees is crucial for evaluating the overall cost of trading cryptocurrencies.

Trading Fees: These fees are charged for executing trades on the broker’s platform. They vary depending on the broker and can be either a flat fee or a percentage of the trade value.

Deposit Fees: Some brokers charge fees for depositing funds into your account. These fees can vary depending on the payment method used and the broker’s policies.

Withdrawal Fees: Similar to deposit fees, withdrawal fees are charged when you transfer funds from your broker account to an external wallet or bank account.

Spread Fees: Spread fees refer to the difference between the bid price and ask price of a cryptocurrency. Brokers may earn a profit through the spread, which can impact the profitability of your trades.

Crypto Broker Security Measures

Security is paramount when dealing with cryptocurrencies due to their digital nature. Crypto brokers implement various security measures to protect your funds and sensitive information.

Two-Factor Authentication (2FA): 2FA adds an extra layer of security by requiring you to provide a second verification factor, such as a code sent to your phone or email, when logging in or making a transaction.

Cold Storage: Reputable brokers store a significant portion of their customers’ funds in cold storage. Cold storage involves keeping cryptocurrencies offline in secure hardware wallets, minimizing the risk of hacking or theft.

Insurance Coverage: Some brokers offer insurance coverage to protect your funds in the event of a security breach or hack. This coverage provides peace of mind and additional security for your investments.

Regulatory Compliance: Brokers that adhere to regulatory frameworks are subject to stringent security audits and inspections, ensuring compliance with industry standards.

Crypto Broker Regulation

Regulation plays a crucial role in protecting investors and ensuring the integrity of the crypto market. Crypto brokers are subject to varying degrees of regulation depending on their jurisdiction and operations.

Licensed Brokers: Licensed brokers are regulated by reputable financial authorities and must meet specific requirements. These authorities oversee the broker’s operations, ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations, and provide investor protection mechanisms.

Unregulated Brokers: Unregulated brokers operate outside the scope of regulatory oversight. This lack of regulation can increase the risk of fraud, scams, and security breaches.

Due Diligence: It is essential to conduct thorough due diligence when choosing a crypto broker. Research their regulatory status, compliance history, and customer reviews to ensure they are reputable and trustworthy.

Investor Protection Mechanisms: Regulated brokers offer various investor protection mechanisms, such as segregated accounts, deposit insurance, and dispute resolution procedures. These mechanisms provide additional layers of protection for your funds and investments.

Living Happy

Living Happy