Car insurance is a legal requirement in most countries, and it’s also a smart way to protect yourself and your vehicle in the event of an accident. But with so many different insurance companies and policies to choose from, getting the right auto insurance quote can be a daunting task.

That’s where this article comes in.

In this article, we’ll provide you with everything you need to know about auto insurance quotes, including what they are, how to get them, and what factors affect the cost of your quote. We’ll also provide some tips for getting the best possible quote on your car insurance.

By the end of this article, you’ll be an expert on auto insurance quotes, and you’ll be able to get the best possible deal on your car insurance.

Understanding Auto Insurance Quotes: A Comprehensive Guide

What is an Auto Insurance Quote?

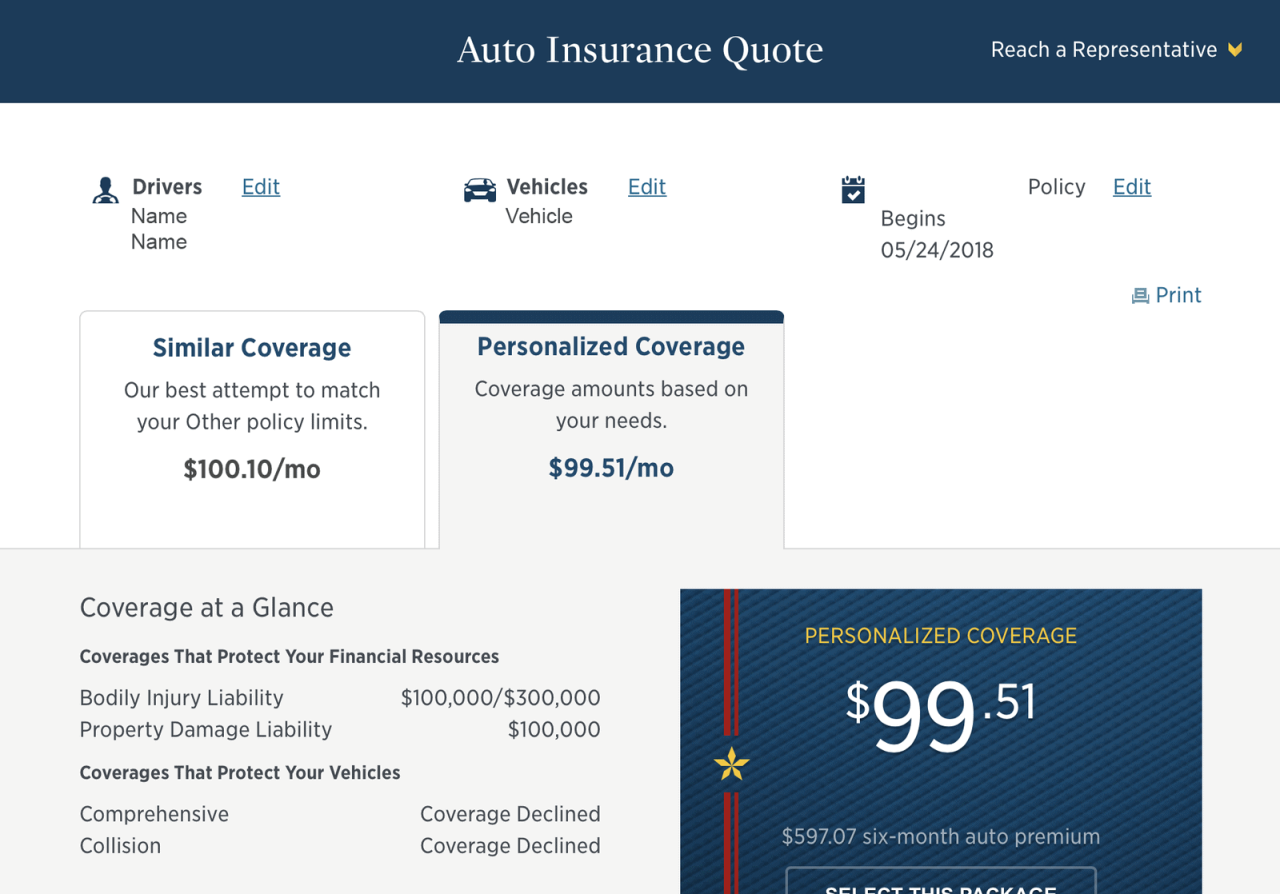

An auto insurance quote is an estimate of the premium you would pay for a specific car insurance policy. It takes into account various factors, including your driving history, vehicle information, coverage needs, and location. By comparing quotes from multiple insurance providers, you can find the most affordable and suitable policy for your situation.

Getting an auto insurance quote is a vital step in securing coverage for your vehicle. It allows you to make informed decisions regarding your coverage options and budget. Remember, your actual premium may differ slightly from the initial quote due to additional factors considered during the underwriting process.

Getting an Auto Insurance Quote

Obtaining an auto insurance quote is a straightforward process. Most insurance companies offer online quoting tools that allow you to quickly and easily receive estimates. You will typically need to provide information about your vehicle, driving history, and coverage requirements.

To ensure you get accurate quotes, be sure to provide complete and accurate information. Consider working with an insurance agent who can guide you through the process and help you understand the different coverage options available.

Factors Affecting Auto Insurance Quotes

Several factors influence the cost of auto insurance. Understanding these factors can help you make informed decisions to lower your premium:

- Driving history: Accidents, traffic violations, and DUIs can significantly increase your insurance rates.

- Vehicle information: The make, model, year, and safety features of your vehicle impact your premium.

- Coverage level: Higher coverage limits and comprehensive coverage options lead to higher premiums.

- Deductible: Choosing a higher deductible can lower your premium, but it means you will pay more out-of-pocket in the event of a claim.

- Location: Insurance rates vary depending on the state or region you live in, due to factors such as traffic congestion and crime rates.

Analyzing Auto Insurance Quotes

Once you have received multiple auto insurance quotes, it is crucial to compare them carefully before making a decision. Consider not only the price but also the following:

- Coverage details: Ensure that all quotes provide the same level of coverage to allow for an accurate comparison.

- Company reputation: Research the reputation and financial stability of each insurance company.

- Customer service: Look for companies with a proven track record of providing excellent customer service.

Choosing the Right Auto Insurance Quote

Choosing the right auto insurance quote involves striking a balance between affordability and the coverage you need. Here are some tips:

- Compare several quotes: Obtain multiple quotes to ensure you are getting the most competitive price.

- Consider your budget: Choose a policy that fits within your financial means while providing adequate coverage.

- Read the policy carefully: Before signing up for a policy, make sure you understand the terms and conditions.

- Ask for discounts: Many insurance companies offer discounts for safe driving, multiple policies, and more.

- Uninsured/Underinsured motorist coverage: Protects you if you are hit by a driver without insurance or with insufficient coverage.

- Rental car reimbursement: Provides coverage for rental car expenses if your vehicle is damaged or stolen.

- Towing and roadside assistance: Covers towing and other roadside emergency services.

Policy Coverage and Options

Understanding Different Coverage Types

Auto insurance policies vary in the types of coverage they offer. Standard coverage includes liability insurance, which covers damages caused to others in an accident. Collision coverage and comprehensive coverage protect your own vehicle from damage caused by accidents or other events, respectively.

Optional coverage options may include:

Customizing Your Coverage

The level of coverage you choose depends on your individual needs and preferences. Consider your driving habits, vehicle value, and financial situation when selecting coverage options. By tailoring your policy to your specific requirements, you can optimize protection and minimize unnecessary expenses.

Insurance Companies and Providers

Selecting a Reputable Insurance Company

Choosing the right insurance company is crucial for a seamless experience and reliable coverage. Consider the company’s reputation, financial stability, and customer satisfaction ratings. Research online reviews, consult independent rating agencies, or seek recommendations from trusted sources.

Look for companies that offer a wide range of coverage options, competitive rates, and excellent customer service. A reputable insurer will provide prompt claims processing, clear communication, and support when you need it most.

Discounts and Savings

Lowering Your Insurance Premium

Numerous discounts are available to help you reduce your auto insurance premium. Safe driving practices, such as maintaining a clean driving record and completing defensive driving courses, can qualify you for discounts on liability coverage.

Multi-policy discounts apply if you bundle your auto insurance with other policies like homeowners or renters insurance. Insurers may also offer discounts for low mileage drivers, students with good grades, and vehicles equipped with anti-theft devices.

Negotiating and Shopping Around

Don’t hesitate to negotiate with your insurance company. If you have a long-standing relationship or have been a low-risk driver, you may be eligible for additional discounts or reduced premiums. Regularly shopping around and comparing quotes from multiple insurers can help you find the best coverage at the most competitive price.

Living Happy

Living Happy