Have you ever wondered what could happen if a client sued your business for a mistake you made? The financial consequences could be devastating. Just when you thought you had done everything right, an oversight or error could put your business in jeopardy.

This is where errors and omissions insurance, commonly known as E&O insurance, steps in. It serves as a safety net to protect your business from the financial burden of lawsuits alleging negligence or mistakes in rendering professional services.

What is Errors and Omissions Insurance (E&O)?

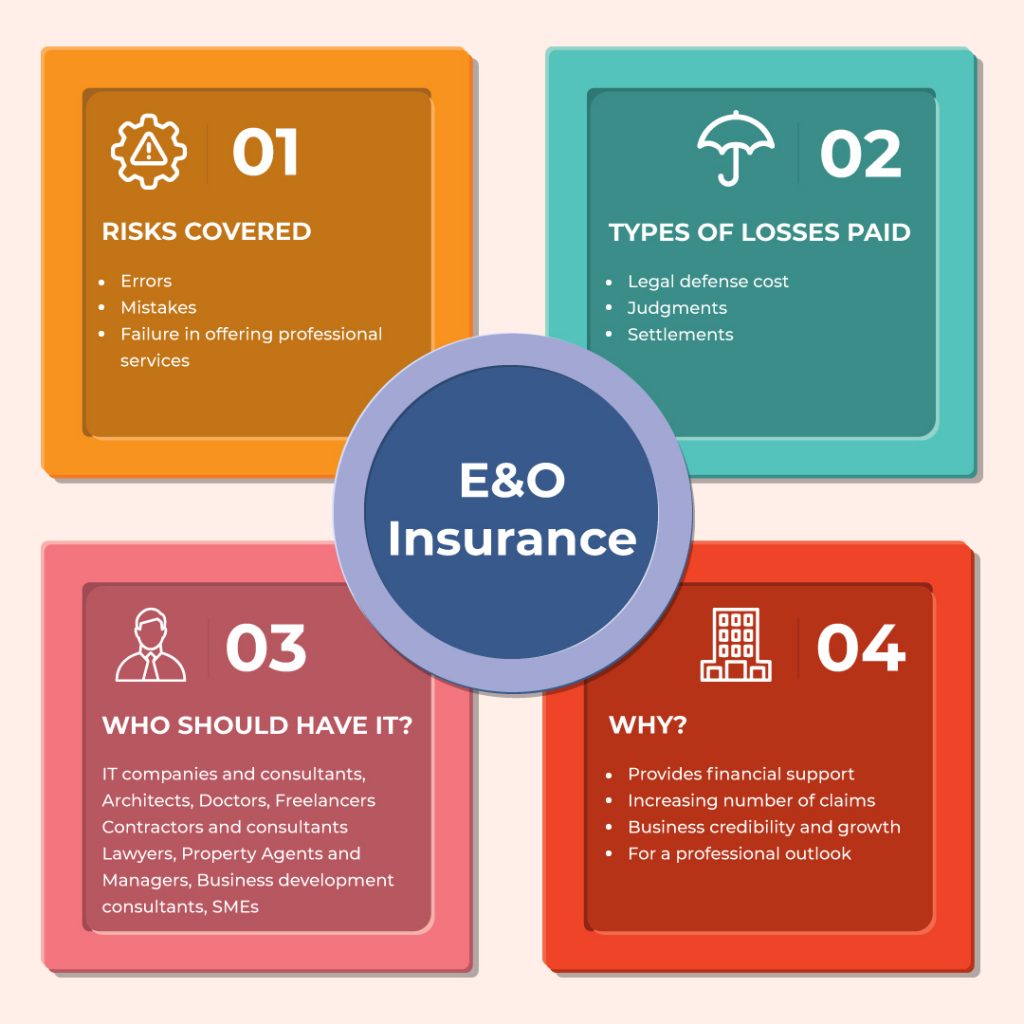

Errors and omissions insurance (E&O) is a type of professional liability insurance that protects businesses and individuals from claims of negligence or errors made in the course of providing professional services.

E&O insurance is essential for businesses that provide professional services, as it can help protect them from the financial consequences of a lawsuit alleging that they made a mistake or failed to perform their services as agreed.

E&O insurance policies typically cover the costs of defending a lawsuit, as well as any damages that are awarded to the plaintiff.

They can also provide coverage for lost income and other expenses incurred as a result of the claim.

The cost of E&O insurance varies depending on the type of business, the level of coverage desired, and the insurance company.

However, the cost of E&O insurance is typically a small price to pay for the peace of mind that it can provide.

Who needs E&O insurance?

Any business that provides professional services should consider purchasing E&O insurance. This includes businesses such as:

Accountants

Architects

Attorneys

Consultants

Doctors

Engineers

Insurance agents

Real estate agents

What does E&O insurance cover?

E&O insurance typically covers claims of negligence or errors made in the course of providing professional services. This includes:

Breach of contract

Negligence

Misrepresentation

Errors or omissions

Defamation

Invasion of privacy

E&O insurance can also provide coverage for lost income and other expenses incurred as a result of a claim.

How much does E&O insurance cost?

The cost of E&O insurance varies depending on the type of business, the level of coverage desired, and the insurance company. However, the cost of E&O insurance is typically a small price to pay for the peace of mind that it can provide.

The following factors can affect the cost of E&O insurance:

The type of business

The size of the business

The level of coverage desired

The insurance company

How to choose an E&O insurance policy

When choosing an E&O insurance policy, it is important to consider the following factors:

The type of business

The size of the business

The level of coverage desired

The insurance company

It is also important to read the policy carefully before purchasing it to make sure that you understand what is covered and what is not.

Benefits of E&O Insurance

E&O insurance offers numerous benefits to businesses and individuals:

Financial protection: It covers the expenses associated with legal defense and potential settlements or judgments.

Peace of mind: Knowing that your business is protected from financial ruin caused by claims of errors or omissions provides peace of mind.

Enhanced reputation: Having E&O insurance demonstrates to clients that you are committed to providing high-quality services and are prepared to take responsibility for any mistakes or oversights.

Competitive advantage: Many clients prefer to work with businesses that carry E&O insurance, as it signals a commitment to professionalism and accountability.

Exclusions and Limitations of E&O Insurance

While E&O insurance provides comprehensive coverage, it does have certain exclusions and limitations:

Intentional acts: Coverage does not extend to damages caused by intentional or willful misconduct.

Criminal acts: Acts that violate criminal laws are not covered by E&O insurance.

Prior acts: Claims arising from errors or omissions that occurred before the policy was obtained are typically excluded.

Deductibles and limits: E&O policies may have deductibles, which represent the amount you have to pay before coverage kicks in, and policy limits, which cap the amount the insurer will pay for damages.

Maintaining E&O Insurance

To maintain E&O insurance coverage, it is essential to:

Pay premiums promptly: Failure to pay premiums on time can result in policy cancellation.

Report claims promptly: Notify your insurer immediately of any claims or potential claims that may arise.

Review coverage regularly: As your business grows and changes, it is important to review your coverage limits and update them as necessary.

Maintain good documentation: Keep records of all your professional activities, including contracts, client communications, and project deliverables. This will help support your claims if needed.

Understanding Liability Coverage in E&O Insurance

E&O insurance typically provides two types of liability coverage: third-party liability and first-party liability. Third-party liability coverage protects your business from lawsuits filed by clients or other individuals who claim to have suffered losses due to your errors or omissions.

In contrast, first-party liability coverage extends protection to your business for claims made by employees or partners within the organization who allege negligence or mistakes on your part.

Choosing the Right Coverage Limits

The appropriate coverage limits for your E&O insurance depend on various factors, such as the nature of your business, the potential risks involved, and the financial resources available to your company.

When determining coverage limits, consider the potential severity of claims against your profession and the likelihood of facing multiple lawsuits simultaneously.

Inadequate coverage limits can leave your business exposed to financial losses, while excessive coverage can lead to unnecessary premiums.

Additional Considerations for E&O Insurance

Importance of Legal Defense Expenses Coverage

E&O insurance policies often include coverage for legal defense expenses, which are crucial for protecting your business from the substantial costs associated with defending against lawsuits.

Legal expenses can quickly accumulate, including attorney’s fees, court costs, expert witness fees, and other litigation-related expenses.

Subrogation Rights in E&O Insurance

Subrogation refers to the insurer’s right to pursue legal action against the party responsible for causing the loss covered by the E&O policy.

Upon paying a claim, the insurer may exercise its subrogation rights to recover the amount paid from the negligent party. This right helps insurers manage their financial exposure and ensures that businesses take reasonable steps to prevent losses.

Dispute Resolution and Arbitration

E&O insurance policies may include provisions for dispute resolution and arbitration.

Arbitration is a form of alternative dispute resolution where a neutral third party, known as an arbitrator, hears the case and makes a binding decision.

Dispute resolution through arbitration can be quicker, more confidential, and less expensive than traditional litigation.

Living Happy

Living Happy