Are you drowning in the sea of expensive insurance premiums? You’re not alone! Finding affordable insurance quotes can be a daunting task, leaving you feeling lost and bewildered. But fear not, intrepid reader! In this comprehensive guide, we’ll navigate the murky waters of insurance policies, empowering you with the knowledge to secure cheap insurance quotes that won’t sink your budget.

From understanding the complexities of coverage to mastering the art of comparison shopping, we’ll equip you with the tools to save money and protect what matters most. So, buckle up and get ready to dive into the world of cheap insurance quotes!

Cheap Insurance Quotes: A Guide to Finding the Best Deals

Factors Affecting Insurance Quotes

Insurance quotes are influenced by numerous factors, including:

- Age and gender: Younger and male drivers tend to have higher premiums due to perceived higher risks.

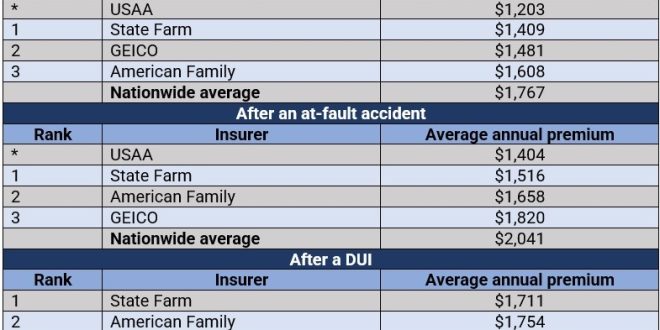

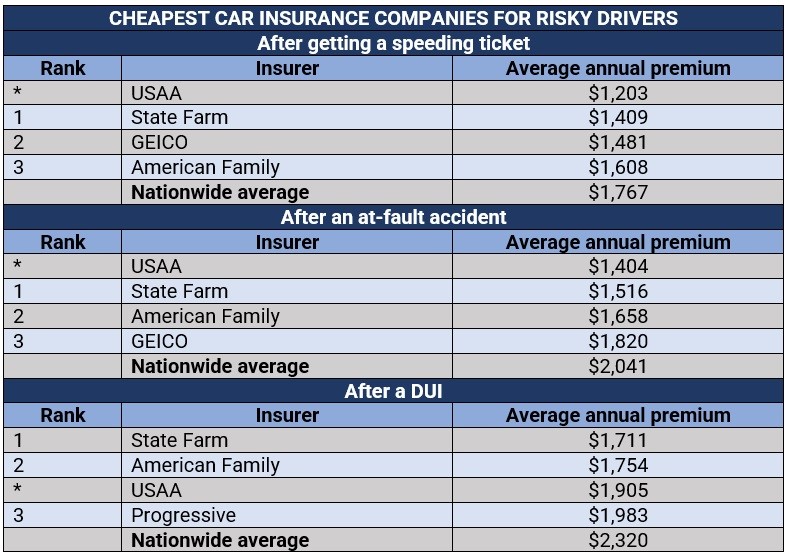

- Driving history: Accidents and violations can significantly increase premiums.

- Location: Premiums vary based on regional crime rates, traffic congestion, and weather conditions.

- Vehicle: The make, model, and safety features of your car impact premiums.

- Coverage level: Higher coverage limits result in higher premiums.

How to Get Cheap Insurance Quotes

To obtain cheap insurance quotes, consider the following tips:

- Shop around: Compare quotes from multiple insurance providers to find the best deals.

- Raise your deductible: Increasing your deductible lowers your premiums but also increases your out-of-pocket expenses in case of a claim.

- Bundle policies: Insuring multiple vehicles or policies with the same provider can result in discounts.

- Maintain a clean driving record: Avoiding accidents and violations can keep your premiums low.

- Consider usage-based insurance: Programs that track your driving habits can reward safe drivers with lower premiums.

Additional Ways to Save on Insurance

In addition to the above, explore these strategies for further savings:

- Enroll in defensive driving courses: Taking approved courses can demonstrate safe driving skills and reduce premiums.

- Maintain a good credit score: Insurers may use credit scores to assess risk and adjust premiums accordingly.

- Ask about discounts: Inquire about potential discounts for military members, good students, and association memberships.

- Negotiate with your insurer: Don’t hesitate to discuss payment plans or discounts that may not be readily offered.

- Review your coverage regularly: As your circumstances change, adjust your coverage to ensure you’re paying for the protection you need.

The Benefits of Cheap Insurance Quotes

Securing cheap insurance quotes offers numerous benefits, including:

- Reduced financial burden: Lower premiums help you save money on monthly expenses.

- Peace of mind: Knowing you have affordable coverage provides peace of mind in case of unexpected events.

- Protection without breaking the bank: Cheap insurance quotes allow you to protect yourself and your loved ones without straining your budget.

Mistakes to Avoid When Getting Cheap Insurance Quotes

To avoid potential pitfalls, be aware of the following mistakes:

- Not shopping around: Failing to compare quotes from multiple providers can result in paying more than necessary.

- Choosing the cheapest option blindly: Prioritize coverage and financial stability over selecting the lowest quote without considering the implications.

- Overestimating your risk: Inflating your coverage level or misrepresenting your driving history can lead to higher premiums.

- Ignoring discounts: Failing to inquire about available discounts for good drivers, safety features, or other qualifications can result in missed savings.

- Not reading the fine print: Carefully review your policy to fully understand your coverage and avoid unexpected surprises in case of a claim.

Understanding Insurance Coverage

Types of Insurance Coverage

Insurance policies provide varying levels of protection. Common types include:

- Liability coverage: Protects you if you cause injuries or damage to others in an accident.

- Collision coverage: Pays for repairs or replacement if your vehicle is damaged in a collision.

- Comprehensive coverage: Covers non-collision damages, such as theft, vandalism, and weather-related incidents.

Coverage Limits and Deductibles

Coverage limits specify the maximum amount an insurer will pay for a covered claim. Deductibles are the amount you pay out-of-pocket before insurance coverage kicks in.

Tips for Maintaining Cheap Insurance Quotes

Maintaining a Good Driving Record

- Avoid speeding tickets and other traffic violations.

- Complete defensive driving courses to refresh your driving skills.

Vehicle Safety Features

Cars with safety features such as airbags, anti-lock brakes, and electronic stability control can qualify for discounts.

Low Annual Mileage

Insurers may offer discounts to drivers who put fewer miles on their vehicles, as they pose less risk.

Advanced Strategies for Saving on Insurance

Telematics Devices

Installing a telematics device that monitors your driving behavior can result in discounts for safe driving.

Group Insurance Plans

Membership in certain groups, such as professional organizations or alumni associations, may provide access to discounted insurance rates.

Insurance Brokers

Professional insurance brokers can represent you and negotiate with multiple insurers on your behalf, potentially securing better deals.

Consider Usage-Based Insurance Programs

Usage-based insurance programs track your driving habits using GPS or telematics devices. Safe drivers are rewarded with lower premiums based on factors such as mileage, braking behavior, and time of day driven.

Factors Affecting Premiums

Insurance companies use complex algorithms to calculate premiums, considering factors such as your age, driving history, location, vehicle type, coverage level, and credit score. Understanding these factors can help you anticipate potential costs and make informed decisions.

Coverage for Specific Circumstances

In addition to standard coverage types, insurers offer specialized options to address specific needs. These include:

- Rideshare insurance: For drivers who transport passengers through services like Uber or Lyft.

- Motorcycle insurance: Provides coverage for motorcycles and scooters.

- Antique or classic car insurance: Specialized policies for vintage or collectible vehicles.

Managing Premium Payments

To avoid financial strain, consider these options for managing premium payments:

- Installment plans: Break down your premium into smaller, more manageable payments.

- Autopay discounts: Some insurers offer discounts for setting up automatic payments.

- Negotiating payment plans: Discuss payment arrangements with your insurer if you experience financial hardship.

Protecting Yourself from Fraud

Be aware of common insurance scams, such as:

- Fake insurance policies: Scammers may sell fraudulent policies that provide no actual coverage.

- Inflated claims: Unlicensed contractors or repair shops may inflate damage estimates to increase payouts.

- Identity theft: Criminals may use stolen personal information to file fraudulent insurance claims.

Living Happy

Living Happy