In today’s digital age, businesses of all sizes rely heavily on accounting software. These innovative tools have transformed the way financial data is recorded, processed, and analyzed. If you’re managing finances, you’ll agree that accuracy and efficiency are paramount.

That’s where accounting software comes in, streamlining processes and ensuring the integrity of your financial records.

Whether you’re new to accounting software or seeking to upgrade your current system, this article will provide valuable insights. We’ll explore the features, benefits, and potential challenges associated with accounting software, empowering you with the knowledge to make informed decisions about its implementation.

Dive into this comprehensive guide and discover how accounting software can revolutionize your approach to financial management.

What is Accounting Software?

An Introduction to Accounting Software

Accounting software, also known as accounting information systems (AIS), is a type of software designed to manage and automate accounting tasks. It’s a powerful tool that simplifies various accounting processes, reducing the workload and increasing efficiency for businesses and individuals.

Accounting software can streamline tasks such as recording financial transactions, generating financial reports, and tracking receivables and payables.

It helps businesses manage their finances more effectively, saving time and effort, and providing insights into their financial performance.

Benefits of Using Accounting Software

There are numerous benefits to using accounting software. Some of the key advantages include:

- Automation: Accounting software automates many accounting tasks, freeing up time for other essential tasks.

- Accuracy: Automated processes reduce errors, ensuring accuracy and reliability in financial records.

- Efficiency: Streamlined processes improve efficiency, allowing businesses to save time and resources.

- Financial Insights: Accounting software provides real-time insights into financial performance, helping businesses make informed decisions.

- Compliance: The software can assist businesses in complying with accounting standards and regulations.

Types of Accounting Software

There are different types of accounting software available, each tailored to specific business needs.

Some of the common types include:

- On-premise Software: Installed on a company’s own servers, providing more control and customization.

- Cloud-based Software: Accessed via the internet, offering flexibility and remote access.

- Open-source Software: Free and customizable, but may require more technical expertise.

- Proprietary Software: Owned and licensed by a specific vendor, offering a comprehensive solution.

Choosing the Right Accounting Software

Factors to Consider When Selecting Accounting Software

Selecting the right accounting software is crucial for businesses. Here are some key factors to consider:

Business Size and Industry: Different accounting software is designed for businesses of various sizes and industries.

Features and Functionality: Evaluate the software’s features and functionality to ensure it meets your specific requirements.

Ease of Use: Choose software that is user-friendly and easy to implement, minimizing training time.

Integration: Consider the software’s ability to integrate with other systems, such as CRM or ERP systems.

Cost: Determine the cost of the software, including licensing fees, maintenance, and support.

Common Challenges of Accounting Software

While accounting software offers numerous benefits, it also comes with potential challenges:

Data Security: Ensure the software has robust security measures to protect sensitive financial data.

Implementation Costs: Implementing accounting software can incur significant costs, including hardware, software, and training.

Data Conversion: Migrating data from an existing system to a new software can be time-consuming and complex.

Training: Employees may require training to use the software effectively, which can be an additional cost.

Conclusion

Embracing Accounting Software for Success

Accounting software plays a vital role in modern financial management. By understanding its benefits, types, and potential challenges, businesses can make an informed decision about implementing accounting software.

With the right software, businesses can streamline financial processes, improve accuracy, gain valuable insights, and enhance overall financial performance in today’s digital age.

Cloud Accounting vs On-Premise Accounting

Understanding the Differences

Two primary deployment models exist for accounting software: cloud-based and on-premise. Cloud accounting is accessed via the internet, while on-premise accounting is installed on a company’s own servers.

Cloud accounting offers flexibility, accessibility from anywhere, and lower upfront costs. On-premise accounting provides more control, customization options, and data security within the company’s infrastructure.

Key Features of Accounting Software

Essential Functions for Efficient Financial Management

Accounting software typically offers a range of core features that streamline financial processes:

- General Ledger: Tracks all financial transactions and provides a comprehensive view of the company’s financial position.

- Accounts Receivable: Manages customer invoices, payments, and accounts receivable aging.

- Accounts Payable: Manages vendor invoices, payments, and accounts payable aging.

- Payroll: Automates the calculation and processing of employee salaries, deductions, and taxes.

- Financial Reporting: Generates financial statements such as the balance sheet, income statement, and cash flow statement.

Mobile Accounting and Financial Management

Accessing Financial Data on the Go

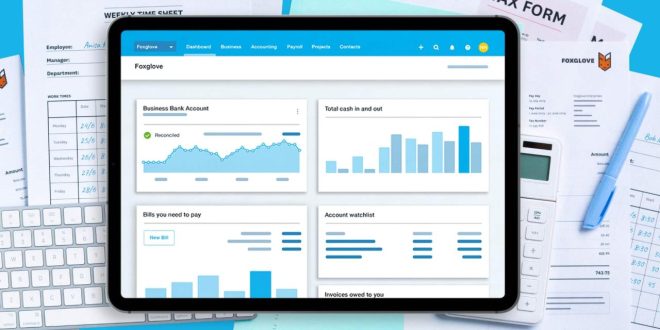

Many accounting software solutions offer mobile apps that allow businesses to access financial data and perform essential tasks remotely.

Mobile accounting apps provide real-time access to financial dashboards, transaction approvals, and report generation, enhancing flexibility and efficiency for managers and employees alike.

Artificial Intelligence in Accounting

Automating Tasks and Improving Efficiency

Artificial intelligence (AI) is increasingly integrated into accounting software, automating tasks and improving efficiency.

AI-powered features can handle data entry, analyze transactions, detect anomalies, and generate insights, freeing up accountants for more complex and strategic tasks.

Data Analytics and Business Intelligence

Leveraging Financial Data for Informed Decision-Making

Accounting software often includes data analytics and business intelligence capabilities that provide valuable insights into financial performance.

Businesses can use these tools to analyze trends, identify areas for improvement, and make data-driven decisions that drive growth and profitability.

Conclusion

Driving Financial Success with Accounting Software

Accounting software is an essential tool for managing finances and driving business success. By understanding the different types, features, and challenges associated with accounting software, businesses can make informed decisions about implementation and leverage technology to streamline financial processes, improve accuracy, and gain valuable insights.

Embracing accounting software empowers businesses to enhance financial performance, make informed decisions, and navigate the ever-changing financial landscape effectively.

Living Happy

Living Happy