In a world where transportation is essential, safeguarding your vehicle with affordable car insurance is paramount. Ensuring your financial protection in the event of an accident or mishap is not just a legal requirement but also a wise investment.

Whether you’re a seasoned driver or a new motorist, finding cheap car insurance that meets your needs and budget can be a daunting task. This comprehensive article aims to unravel the complexities of affordable car insurance, empowering you with the knowledge and strategies to secure the best coverage at a price that doesn’t break the bank.

From understanding insurance terms and discounts to leveraging technology and exploring alternative options, we’ll guide you through the intricacies of this essential financial tool, ensuring you drive with peace of mind and without the burden of exorbitant insurance premiums.

Affordable Car Insurance: The Ultimate Guide to Saving Money

Understanding Car Insurance Basics

Navigating the world of car insurance can be overwhelming, but understanding its fundamentals is crucial for finding affordable coverage. Car insurance essentially protects you financially if you’re ever involved in an accident.

There are three main types of insurance: liability, collision, and comprehensive. Liability covers damages caused to others, collision covers damages to your car, and comprehensive covers damages from non-collision events like theft or weather.

The cost of your insurance premium is determined by various factors, including your driving history, vehicle type, age, and location. To reduce your premium, consider improving your driving record and choosing a car with lower risk factors.

Also, consider raising your deductible, the amount you pay out-of-pocket before insurance kicks in. A higher deductible typically lowers your premium, but ensure you can afford it in case of an accident.

Finding Affordable Car Insurance through Comparison Shopping

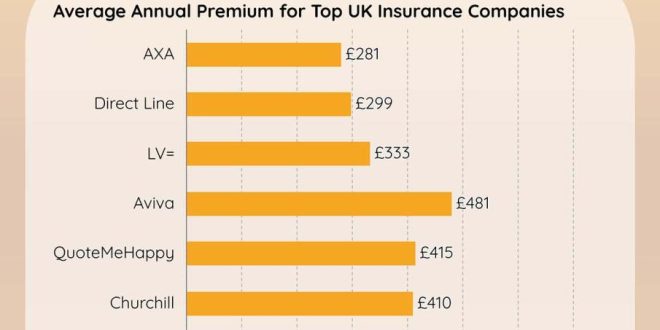

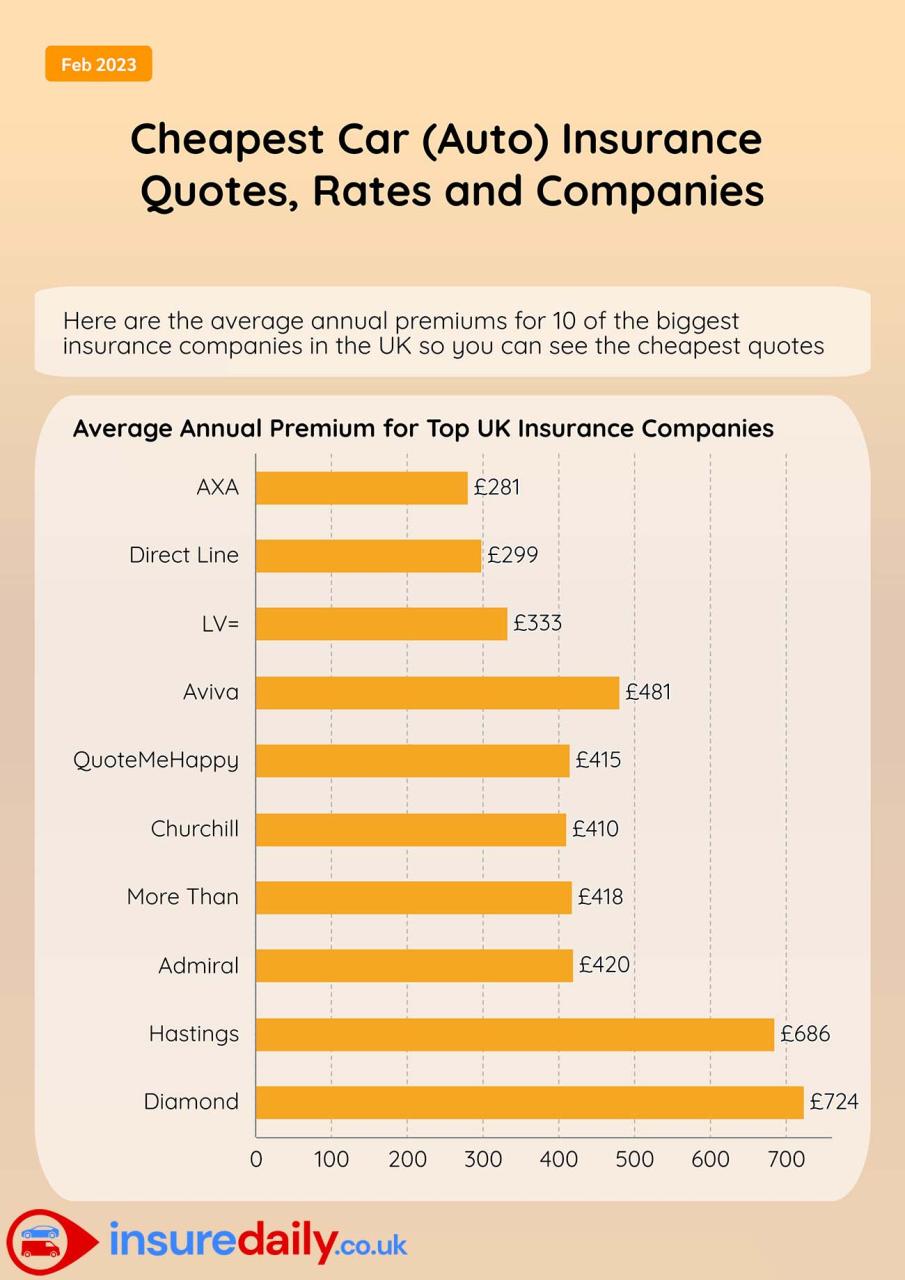

The key to finding affordable car insurance is comparing quotes from multiple insurers. This way, you can lock in the best rates and coverage options that suit your needs.

Use online comparison tools or consult with an insurance agent to gather quotes from various providers. Be sure to provide accurate information to receive precise quotes. Compare plans thoroughly, considering factors like coverage limits, deductibles, and policy exclusions.

Don’t hesitate to negotiate with insurers. If you have a good driving record or are willing to switch companies, you may be able to secure further discounts.

Tips for Lowering Car Insurance Costs

Beyond comparison shopping, there are additional strategies to reduce your insurance costs:

- Bundle policies: Combine multiple insurance policies, such as car, home, and renter’s insurance, with a single insurer for discounts.

- Maintain a clean driving record: Avoid traffic violations and accidents to keep your premium low.

- Look for discounts: Ask insurers about potential discounts for things like defensive driving courses, good grades, and vehicle safety features.

- Increase your deductible: Raising your deductible can significantly lower your premium.

However, ensure you’re comfortable with the higher out-of-pocket costs in the event of an accident.

- Shop around regularly: Don’t stick with the same insurance provider indefinitely. Regularly compare quotes from other insurers to ensure you’re getting the best deal.

Conclusion

Finding affordable car insurance is possible with the right approach. Understanding the basics, comparison shopping, and utilizing cost-saving strategies can empower you to secure the coverage you need at a reasonable price. Remember, the goal is to strike a balance between affordability and adequate protection.

Take the time to research and compare options to find the perfect plan that meets your individual needs and budget.

Factors Influencing Car Insurance Premiums

Personal Characteristics

Your age, gender, marital status, and driving history significantly impact your car insurance premiums. Younger drivers, males, and unmarried individuals typically pay higher rates due to their perceived higher risk profiles.

Maintaining a clean driving record with no accidents or traffic violations is crucial for keeping your premiums low. On the other hand, traffic violations and accidents can result in rate increases and surcharges.

Vehicle-Related Factors

The type, value, and safety features of your vehicle also influence your insurance costs. Sports cars, luxury vehicles, and high-value cars command higher premiums due to their increased risk of theft and costly repairs.

However, vehicles equipped with advanced safety features such as airbags, anti-lock brakes, and electronic stability control can qualify for discounts as they reduce the likelihood of accidents.

Location and Crime Rates

The location where you live and the prevalence of crime in that area affect your insurance premiums. Urban areas with higher rates of accidents, vandalism, and theft pose a greater risk to insurers, resulting in higher premiums.

Insurers also consider the proximity of your residence to major roads and highways, as these areas tend to have more traffic and a higher likelihood of accidents.

Coverage Options and Deductibles

The level of coverage you choose and the amount of your deductible directly impact your insurance premiums. Liability-only coverage is the most affordable option, but it provides minimal protection.

Collision and comprehensive coverage offer more comprehensive protection, but they come with higher premiums. The deductible you choose affects your premium as well, with higher deductibles leading to lower premiums.

Alternatives to Traditional Car Insurance

Usage-Based Insurance (UBI)

UBI programs track your driving habits and adjust your premiums based on factors such as mileage, hard braking, and speed. This can be a cost-effective option for low-mileage drivers or those who practice safe driving habits.

Insurance companies typically install a telematics device in your vehicle to gather driving data, and discounts are applied accordingly.

Ride-Sharing Insurance

If you use ride-sharing services like Uber or Lyft, traditional car insurance policies may not provide adequate coverage. Ride-sharing insurance offers specific policies designed to cover the unique risks associated with driving for these services.

These policies provide coverage during both personal and ride-sharing trips, ensuring you’re protected while earning additional income.

Living Happy

Living Happy