Are you struggling with student loan debt that you believe was taken out under false pretenses? Do you suspect that your school misled you about your career prospects or the worth of your education? If so, you may be eligible for ‘borrowers defense,’ a federal program that allows you to have your student loans forgiven or discharged.

In this article, we’ll delve into the realm of borrowers defense, explaining what it is, how to qualify, and the potential benefits and challenges of pursuing this option. Join us as we explore this important topic and provide insights that can help you navigate the complexities of student loan forgiveness.

Borrowers Defense to Repayment

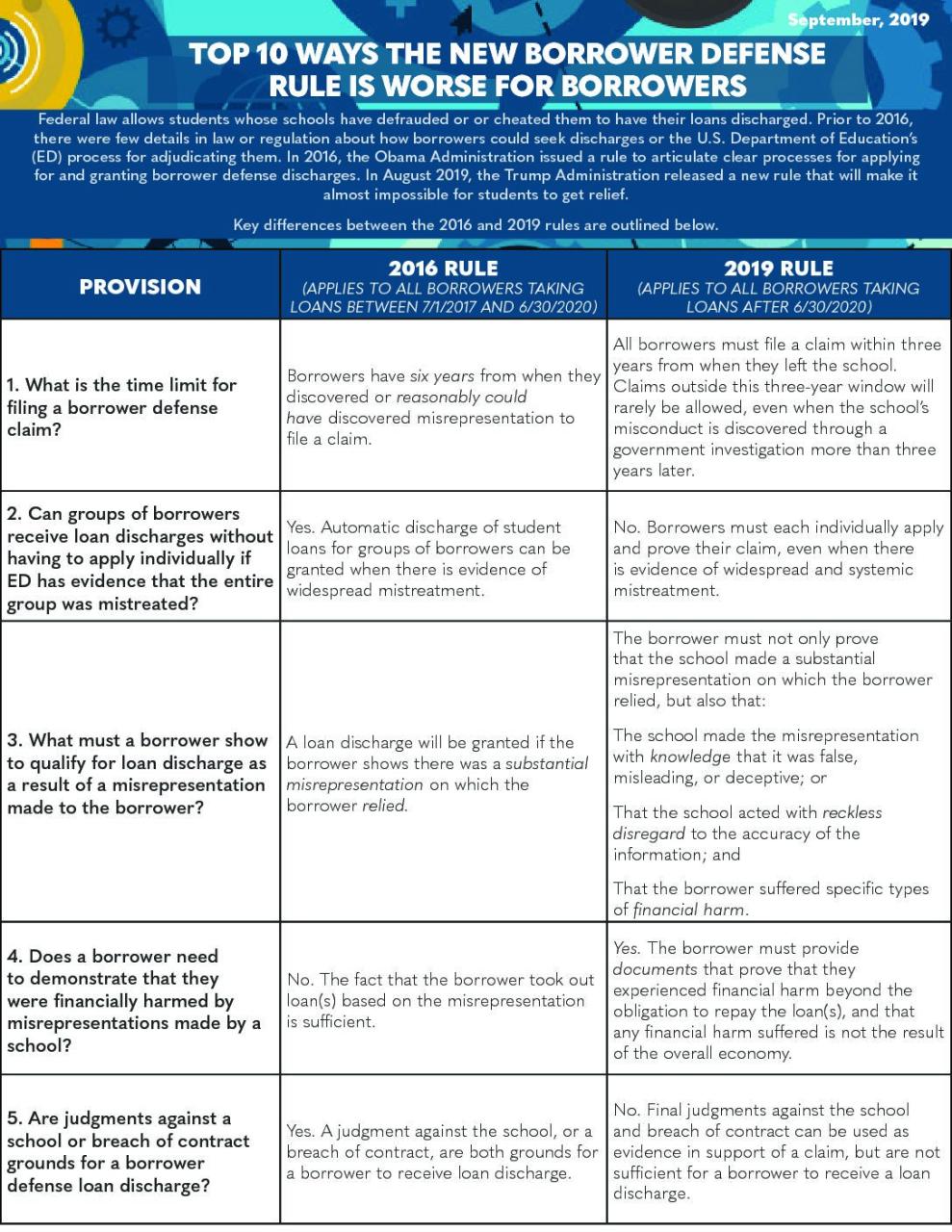

Borrowers Defense to Repayment is a federal program that allows federal student loan borrowers to have their loans discharged if they were defrauded by their school. This program was created in response to the large number of complaints from borrowers who said they were misled by their schools about the cost of their education, the job prospects for graduates, or the accreditation of their programs.

To be eligible for Borrowers Defense to Repayment, borrowers must meet all of the following criteria:

- They must have been enrolled in a school that was participating in a federal student loan program.

- They must have borrowed a federal student loan to attend the school.

- They must have been defrauded by the school.

- They must have suffered financial harm as a result of the fraud.

If you believe that you may be eligible for Borrowers Defense to Repayment, you can submit an application to the U.S. Department of Education. The application process is complex, and it is important to seek legal advice before you submit an application.

How to Apply for Borrowers Defense to Repayment

To apply for Borrowers Defense to Repayment, you must submit an application to the U.S. Department of Education. The application is available online at the Federal Student Aid website. The application process is complex, and it is important to seek legal advice before you submit an application.

The application requires you to provide detailed information about your experience with the school, including:

- The name of the school

- The dates you attended the school

- The degree or certificate you received

- The amount of student loans you borrowed

- The basis of your claim that you were defrauded

- The financial harm you suffered as a result of the fraud

You must also submit supporting documentation with your application, such as:

- Copies of your student loan records

- Copies of your transcripts

- Copies of any correspondence you had with the school

What Happens After You Submit an Application?

After you submit an application for Borrowers Defense to Repayment, the U.S. Department of Education will review your application and make a decision about whether to discharge your loans. The Department of Education may also investigate your school to determine whether it engaged in any fraudulent practices.

If the Department of Education approves your application, your loans will be discharged. This means that you will no longer be obligated to repay the loans.

What if My Application is Denied?

If your application for Borrowers Defense to Repayment is denied, you can appeal the decision. The appeal process is complex, and it is important to seek legal advice before you appeal.

If your appeal is successful, your loans will be discharged. If your appeal is denied, you will still be obligated to repay your loans.

Benefits of Borrowers Defense

Borrowers Defense to Repayment can provide significant benefits to eligible borrowers. These benefits include:

- Loan forgiveness: If your application for Borrowers Defense to Repayment is approved, your student loans will be forgiven. This means that you will no longer be obligated to repay the loans.

- Refund of payments: If you have already made payments on your student loans, you may be eligible for a refund of those payments. The refund will be for the amount of payments you made after the date that you were defrauded.

- Improved credit score: If your student loans are forgiven, your credit score will improve. This can make it easier for you to qualify for other forms of credit, such as a mortgage or car loan.

Challenges of Pursuing Borrowers Defense

Pursuing Borrowers Defense to Repayment can be challenging. Some of the challenges include:

- The application process is complex: The application for Borrowers Defense to Repayment is complex and requires you to provide detailed information about your experience with the school. It is important to seek legal advice before you submit an application.

- The process can take a long time: The Department of Education can take a long time to review your application and make a decision. The process can take several months or even years.

- Your application may be denied: Even if you meet all of the eligibility criteria, your application for Borrowers Defense to Repayment may be denied. The Department of Education has broad discretion to decide whether to approve or deny applications.

Alternative Options for Student Loan Forgiveness

If you are not eligible for Borrowers Defense to Repayment, there may be other options available to you for student loan forgiveness. These options include:

- Public Service Loan Forgiveness: If you work in public service, you may be eligible for Public Service Loan Forgiveness. This program forgives the remaining balance of your student loans after you have made 120 qualifying payments.

- Teacher Loan Forgiveness: If you are a teacher, you may be eligible for Teacher Loan Forgiveness. This program forgives the remaining balance of your student loans after you have taught for five years in a low-income school.

- Income-Driven Repayment: If you have federal student loans, you may be eligible for an income-driven repayment plan. These plans cap your monthly student loan payments at a percentage of your income. If you remain on an income-driven repayment plan for 20 or 25 years, the remaining balance of your student loans will be forgiven.

Living Happy

Living Happy