Are you navigating the labyrinthine world of car insurance, bewildered by the plethora of companies vying for your attention? Car insurance is not a trivial matter; it’s a lifeline protecting you from financial ruin in the event of an accident.

Choosing the right insurance company is pivotal, as it can save you money, provide peace of mind, and ensure you’re adequately covered when disaster strikes. In this article, we embark on a journey to explore the intricate landscape of car insurance companies, unraveling their differences, evaluating their offerings, and empowering you to make an informed decision that safeguards your financial future.

Car Insurance Companies: A Comprehensive Guide

Navigating the Intricacies of Car Insurance Coverage

Navigating the complex landscape of car insurance can be a daunting task. With a plethora of companies offering diverse coverage options, selecting the right provider is crucial. Our comprehensive guide delves into the intricacies of car insurance, empowering you with the knowledge to make informed decisions.

Numerous factors influence car insurance premiums, including driving history, vehicle type, and location. Understanding these factors enables you to optimize your coverage while minimizing costs. Our expert insights will guide you through the process, ensuring you secure the protection your vehicle deserves.

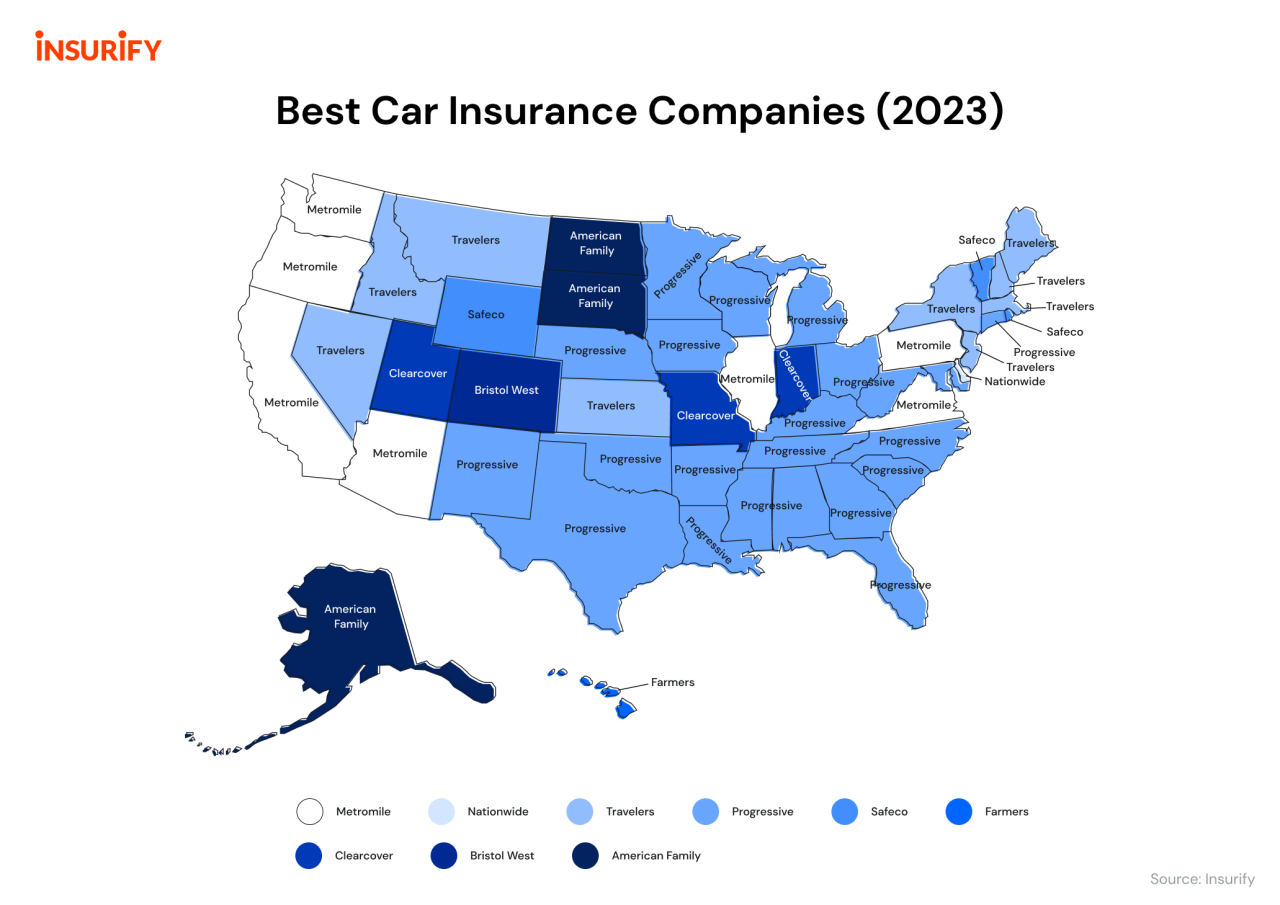

Exploring the Top Car Insurance Providers

The market abounds with reputable car insurance companies, each offering unique benefits and drawbacks. To assist you in identifying the ideal provider for your needs, we have meticulously analyzed the top insurers, providing in-depth reviews of their coverage options, customer service, and financial stability.

Our comprehensive analysis empowers you to make well-informed choices, selecting an insurer that aligns with your specific requirements and budget. Say goodbye to haphazard insurance decisions and embrace a tailored approach that safeguards your vehicle and your financial well-being.

Understanding Car Insurance Coverage Options

Car insurance policies encompass a spectrum of coverage options, catering to diverse needs and circumstances. Understanding the intricacies of each coverage type is paramount to tailoring your policy effectively.

From comprehensive and collision coverage to liability protection and uninsured/underinsured motorist coverage, our guide provides an accessible and comprehensive overview of the insurance landscape. Empower yourself with knowledge to make informed choices that safeguard you against financial setbacks in the event of an accident or other covered incident.

Tips for Saving Money on Car Insurance

Securing affordable car insurance premiums without compromising coverage is a shared aspiration among drivers. Our expert advice reveals a treasure trove of money-saving tips, empowering you to optimize your insurance costs effectively.

From leveraging discounts and maintaining a clean driving record to exploring alternative coverage options, our guide unveils the secrets to minimizing your insurance expenses. Embrace our practical insights and witness substantial savings on your car insurance premiums, freeing up your budget for other essential expenses.

Types of Car Insurance Companies

National vs. Regional vs. Local Insurance Companies

Car insurance companies vary in their geographic reach. National companies operate across the country, while regional companies serve specific regions, and local companies focus on a limited area. National companies often offer a broader range of coverage options and may have more resources, but they can also be more expensive.

Regional companies typically have lower rates than national companies, but they may offer fewer coverage options. Local companies usually have the lowest rates but may have limited coverage options and smaller financial reserves.

Direct vs. Agent-Based Insurance Companies

Car insurance companies can sell their policies directly to consumers or through agents. Direct companies offer lower rates than agent-based companies, but they may provide less personalized service.

Agent-based companies offer more personalized service and can help you find the right coverage for your needs, but they come with higher rates. Agents may also be able to offer discounts and other benefits that direct companies do not.

Evaluating Car Insurance Companies

Coverage Options and Exclusions

Car insurance policies vary in the coverage options and exclusions they offer. Some policies may include comprehensive coverage, which covers damage to your car from all causes, while others may only include collision coverage, which covers damage to your car from a collision with another car or object.

It’s important to read the policy carefully to understand the coverage options and exclusions that apply to your policy. You should also consider your individual needs and circumstances when choosing a policy.

Financial Stability and Customer Service

It’s important to consider the financial stability and customer service of a car insurance company before you purchase a policy. A financially stable company is more likely to be able to pay your claims and provide ongoing support.

Customer service is also an important consideration. You want to choose a company that is responsive to your questions and concerns. You should also read reviews from other customers to get an idea of the company’s customer service.

Comparative Analysis of Car Insurance Companies

Premium Comparison and Coverage Assessment

To make an informed decision, compare premiums from multiple car insurance companies. Consider factors such as coverage levels, deductibles, and discounts. Avoid focusing solely on low premiums; ensure the coverage adequately protects your needs.

Assess the scope of coverage provided by each company. Comprehensive policies offer broader protection than collision or liability-only policies. Tailor your policy to match your specific risks and financial capabilities.

Policy Customization and Additional Services

Tailoring Policies to Individual Needs

Car insurance companies offer flexible policies to cater to diverse customer requirements. Options include adding endorsements or riders to enhance coverage, such as gap insurance for leased vehicles or roadside assistance for emergencies.

Consult an insurance agent to explore customization options and find the perfect balance between coverage and affordability. Consider your lifestyle, driving habits, and vehicle value when tailoring your policy.

Reputation, Reviews, and Industry Recognition

Reputation and Customer Feedback

Research car insurance companies’ reputations by reading customer reviews and industry ratings. Positive feedback indicates high customer satisfaction, reflecting the quality of service, claims handling, and overall experience.

Consider companies with a proven track record of financial stability, low complaint ratios, and industry awards or recognition. These indicators demonstrate reliability and trustworthiness.

Technological Advancements and Innovation

Embracing Technology for Convenience

Modern car insurance companies leverage technology to enhance the customer experience. Mobile apps provide convenient access to policy details, claims reporting, and roadside assistance. Telematics devices monitor driving behavior, potentially leading to discounts for safe drivers.

Consider companies that offer innovative features and embrace technological advancements to streamline the insurance process and provide value-added services.

Living Happy

Living Happy