Navigating the complexities of car ownership can be daunting, especially when it comes to understanding insurance policies. One of the crucial decisions you’ll make is determining the type of coverage that best protects you and your vehicle: full coverage car insurance.

This comprehensive insurance is designed to provide peace of mind by offering a wide range of benefits, yet many drivers remain unaware of its details and significance. This article aims to demystify full coverage car insurance, explaining its components, why it matters, and the advantages it offers.

By understanding its nuances, you can make an informed decision that safeguards your investment and ensures you’re prepared for unexpected events on the road.

Full Coverage Car Insurance: An Essential Guide

Full coverage car insurance is a comprehensive type of insurance that provides the most protection for your vehicle and yourself. This policy includes:

- Liability coverage

- Collision coverage

- Comprehensive coverage

- Uninsured/underinsured motorist coverage

If you’re looking for the most comprehensive coverage for your car, then full coverage is the way to go.

Benefits of Full Coverage Car Insurance

There are many benefits to having full coverage car insurance. Here are a few of the most important:

- Peace of mind. Knowing that you have full coverage will give you peace of mind while you’re on the road.

- Financial protection. If you’re in an accident, full coverage will help to protect you from financial ruin.

- Coverage for all types of accidents. No matter what type of accident you’re in, full coverage will provide you with the protection you need.

- Help with repairs. If your car is damaged in an accident, full coverage will help to pay for repairs.

- Coverage for medical expenses. If you or your passengers are injured in an accident, full coverage will help to pay for medical expenses.

Who Needs Full Coverage Car Insurance?

Full coverage car insurance is a good option for anyone who wants the most comprehensive coverage for their vehicle. This includes:

- Drivers with new cars

- Drivers with expensive cars

- Drivers who drive a lot

- Drivers who live in areas with a high rate of accidents

How Much Does Full Coverage Car Insurance Cost?

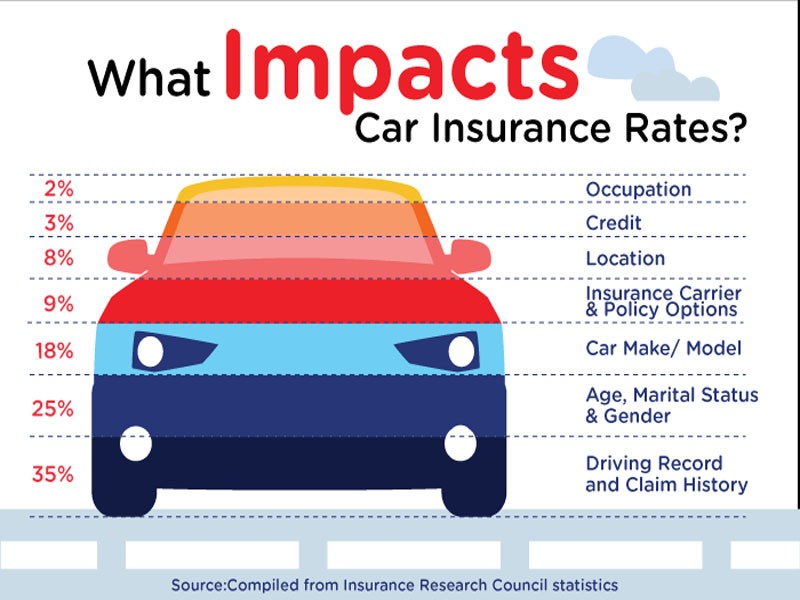

The cost of full coverage car insurance will vary depending on a number of factors, including:

- Your age

- Your driving record

- Your credit score

- The type of car you drive

- The amount of coverage you choose

- The deductible you choose

You can get a quote for full coverage car insurance from your insurance agent.

Understanding Liability Coverage

Liability coverage is a crucial component of full coverage car insurance that protects you financially if you cause an accident that results in bodily injury or property damage to others. This coverage includes:

- Bodily injury liability: Covers medical expenses and lost wages for individuals injured in the accident you caused.

- Property damage liability: Compensates for damages to vehicles, structures, or other property caused by your at-fault driving.

- Theft: Covers the cost of replacing or repairing your stolen vehicle, even if it’s never recovered.

- Vandalism: Reimburses you for damages caused by malicious acts, such as broken windows or dents.

- Natural Disasters: Protects against vehicle damage caused by events like hurricanes, hailstorms, or floods.

- Bodily injury coverage: Pays for medical expenses and lost wages in case of injuries sustained in such an accident.

- Property damage coverage: Compensates for damages to your vehicle if the at-fault driver lacks adequate coverage.

- Intentional acts: Damages caused by intentional acts, such as driving under the influence or racing, are not covered.

- Mechanical breakdowns: Repairs or replacements resulting from mechanical failures or wear and tear are not included.

- Acts of war: Damages caused by war, terrorism, or other acts of violence may not be covered.

- Age and driving experience: Younger drivers with less experience typically pay higher premiums due to increased risk.

- Driving record: A history of accidents or traffic violations can result in higher premiums.

- Vehicle type and value: More expensive and powerful vehicles typically carry higher premiums.

- Location: Areas with higher accident rates or theft risks may lead to increased premiums.

- Deductible: A higher deductible can lower premiums, but it also means a larger out-of-pocket expense in case of a claim.

- Rental car reimbursement: Covers the cost of renting a vehicle while yours is being repaired or replaced after an accident.

- Roadside assistance: Provides emergency services like towing, flat tire repair, and fuel delivery.

- Gap insurance: Covers the difference between the actual cash value of your car and the amount you still owe on the loan in case of a total loss.

Collision Coverage vs Comprehensive Coverage

Collision Coverage

Collision coverage protects your vehicle in the event of a collision with another vehicle or object, such as a tree or guardrail. It covers damages regardless of who is at fault, ensuring repairs or replacement costs for your own car.

Comprehensive Coverage

Comprehensive coverage extends beyond collisions and provides protection against non-collision incidents, including:

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you and your passengers if you’re involved in an accident with a driver who has no insurance or insufficient insurance. This coverage provides:

Exclusions and Limitations of Full Coverage Car Insurance

While full coverage car insurance offers comprehensive protection, it’s important to be aware of certain exclusions and limitations that may apply. These typically include:

Factors Influencing Full Coverage Car Insurance Premiums

The cost of full coverage car insurance premiums varies depending on several factors that insurance companies consider when assessing risk. These include:

Additional Coverage Options for Enhanced Protection

In addition to the core components of full coverage car insurance, some insurers offer additional coverage options to enhance protection, such as:

Living Happy

Living Happy