In the labyrinth of life’s uncertainties, life insurance emerges as a beacon of security, providing a financial lifeline for our loved ones when the unpredictable strikes. Whether you’re starting a family, planning for retirement, or simply navigating the complexities of life, securing your future with life insurance is a prudent decision.

This article will delve into the intricacies of life insurance, guiding you through the essential concepts, common challenges, and valuable insights to help you make informed choices that safeguard the well-being of those you cherish. Prepare to unravel the significance of life insurance and discover how it empowers you to face life’s challenges with confidence and resilience.

Life Insurance: A Comprehensive Guide for Securing Your Future

What is Life Insurance?

Life insurance is a financial contract that provides monetary compensation to your beneficiaries upon your death. It offers peace of mind, knowing that your loved ones will receive a financial safety net when they need it most.

Life insurance policies come in various types, each tailored to meet specific needs and financial situations.

Types of Life Insurance

Life insurance policies can be categorized into two main types:

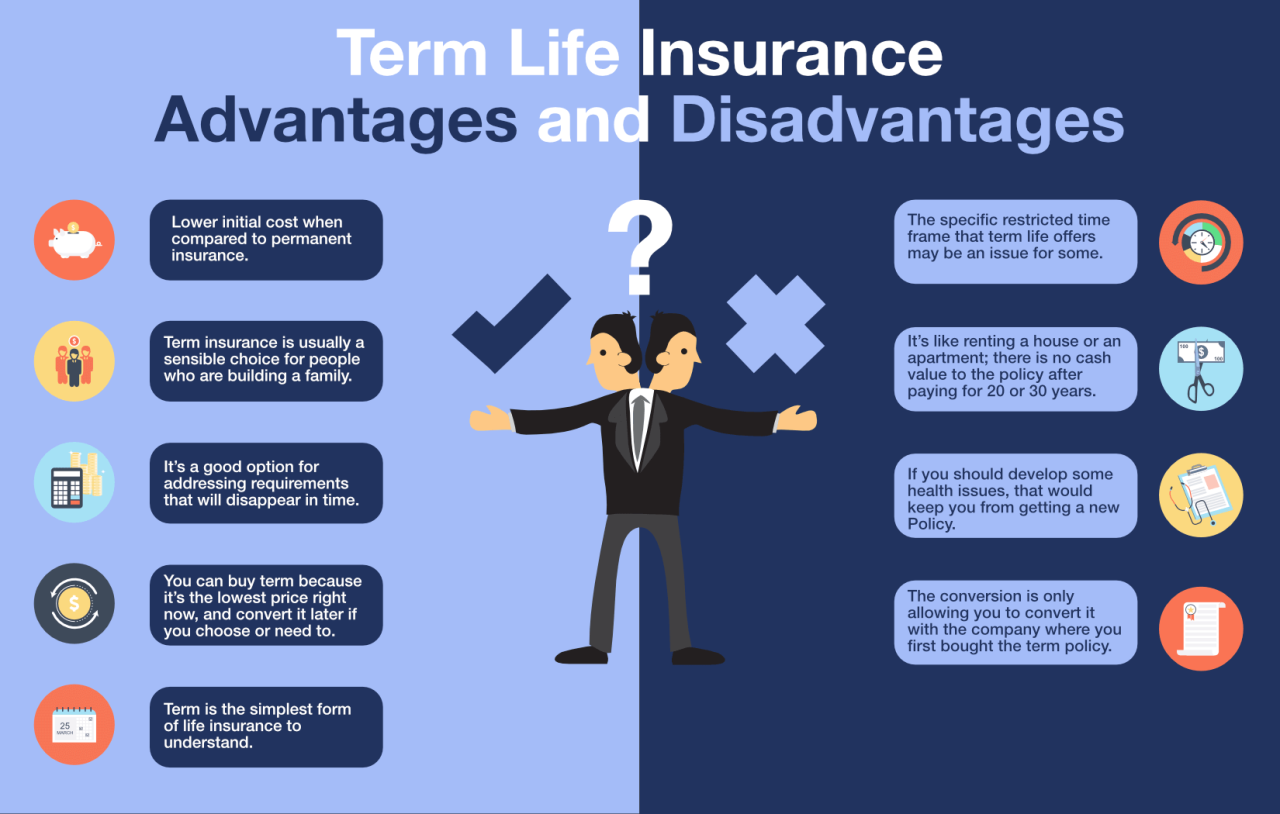

- Term Life Insurance: Coverage for a specified period, typically ranging from 10 to 30 years. It is more affordable but does not offer lifelong protection.

- Permanent Life Insurance: Lifelong coverage that remains in effect until your death.

It offers cash value accumulation, which can serve as a savings or investment tool.

Benefits of Life Insurance

Life insurance offers numerous advantages, including:

- Financial Security: Provides a substantial sum to your beneficiaries, ensuring their financial stability after your passing.

- Mortgage Protection: Allows your family to pay off your mortgage in the event of your death, preventing foreclosure.

- Educational Funding: Secures your children’s education by providing funds for their tuition and other expenses.

Choosing the Right Life Insurance Policy

Selecting the appropriate life insurance policy requires thoughtful consideration of several factors:

- Coverage Amount: Determine the amount of financial support your beneficiaries will need to cover expenses and maintain their standard of living.

- Policy Term: Choose the coverage duration that aligns with your financial goals and the future needs of your dependents.

- Beneficiaries: Specify the individuals who will receive the policy payout upon your death.

Key Considerations in Life Insurance Planning

Effective life insurance planning requires attention to specific considerations:

- Income Replacement: Estimate your current and future income to determine the amount of coverage needed to maintain your family’s financial well-being.

- Financial Obligations: Consider outstanding debts, such as mortgages, loans, and credit card balances, to ensure sufficient coverage for their repayment.

- Funeral Expenses: Factor in the costs associated with funeral arrangements and burial or cremation services.

Factors Influencing Life Insurance Premiums

Life insurance premiums are determined by various factors that impact the insurer’s risk assessment:

- Age and Health: Older individuals and those with pre-existing health conditions may face higher premiums due to increased mortality risk.

- Tobacco Use: Smokers typically pay higher premiums because of the increased health risks associated with smoking.

- Occupation: Certain occupations with higher risks, such as firefighters or police officers, may warrant higher premiums.

Additional Benefits of Life Insurance

Beyond the primary benefits of financial security, life insurance offers additional advantages:

- Estate Planning Tool: Life insurance can be used to transfer wealth and reduce estate taxes.

- Legacy Preservation: It allows you to leave a legacy for your loved ones, supporting their future goals.

- Tax-Deferred Growth: Permanent life insurance policies with cash value components offer tax-deferred growth, potentially increasing the policy’s value over time.

Expert Insights on Life Insurance

The Role of Financial Advisors

Seeking guidance from a reputable financial advisor can prove invaluable when navigating the complexities of life insurance. Advisors provide personalized recommendations based on your specific financial situation and goals, ensuring that your life insurance strategy aligns with your overall financial plan.

Financial advisors can help you:

- Assess your current and future financial needs

- Explore different life insurance options

- Compare policies and premiums

Long-Term Planning

Life insurance is not merely a quick fix but an essential part of long-term financial planning. By securing life insurance early, you lock in lower premiums and protect against unforeseen circumstances. Additionally, permanent life insurance policies allow you to build cash value that can serve as a valuable savings tool.

Long-term planning with life insurance ensures that:

- Your family’s financial future is secure

- You reach your retirement savings goals

- You mitigate potential financial risks

Common Misconceptions and Considerations

Myth: I’m Healthy, So I Don’t Need Life Insurance

While good health is indeed a blessing, it does not guarantee immunity from unforeseen events. Accidents, illnesses, and other unpredictable situations can strike at any time. Life insurance provides peace of mind by ensuring that your loved ones are financially protected should the worst happen.

Factor: Lifestyle Changes

Life insurance premiums can be affected by changes in your lifestyle. If you quit smoking, improve your health, or embark on a career with lower risk, you may qualify for lower premiums. It’s important to keep your insurer informed of such changes to ensure accurate pricing.

Maximizing Your Life Insurance Benefits

Rider Options

Consider adding riders to your life insurance policy for enhanced coverage. Riders are additional benefits that provide extra protection, such as:

- Accidental death and dismemberment (AD&D)

- Waiver of premium (in case of disability)

- Child term coverage

Regular Reviews

Your life insurance policy should be reviewed regularly to ensure that it continues to meet your changing needs. As your income, family situation, and financial goals evolve, it’s crucial to adjust your coverage accordingly. Periodic reviews help you stay adequately protected and avoid potential coverage gaps.

Living Happy

Living Happy