Discover the secrets to mastering QuickBooks Online pricing! In today’s competitive business landscape, managing your finances effectively is crucial. QuickBooks Online, a renowned accounting software, offers a range of flexible pricing plans to cater to every business need.

Whether you’re a small business owner or a large enterprise, understanding the pricing structure is essential to maximize your return on investment. In this article, we’ll delve into the different QuickBooks Online pricing options, explore their features, and provide expert guidance to help you choose the right plan for your business.

By the end, you’ll have a clear understanding of the pricing models, empowering you to make informed decisions that support your financial success.

QuickBooks Online Pricing: A Comprehensive Guide

>

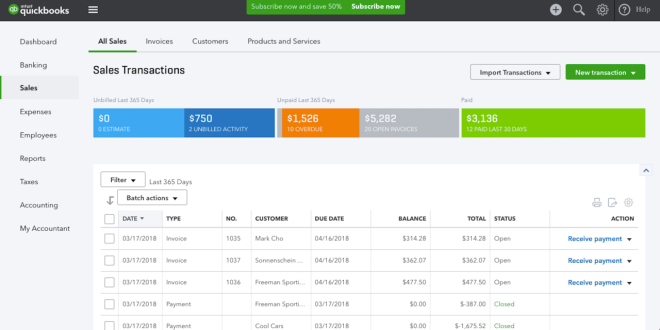

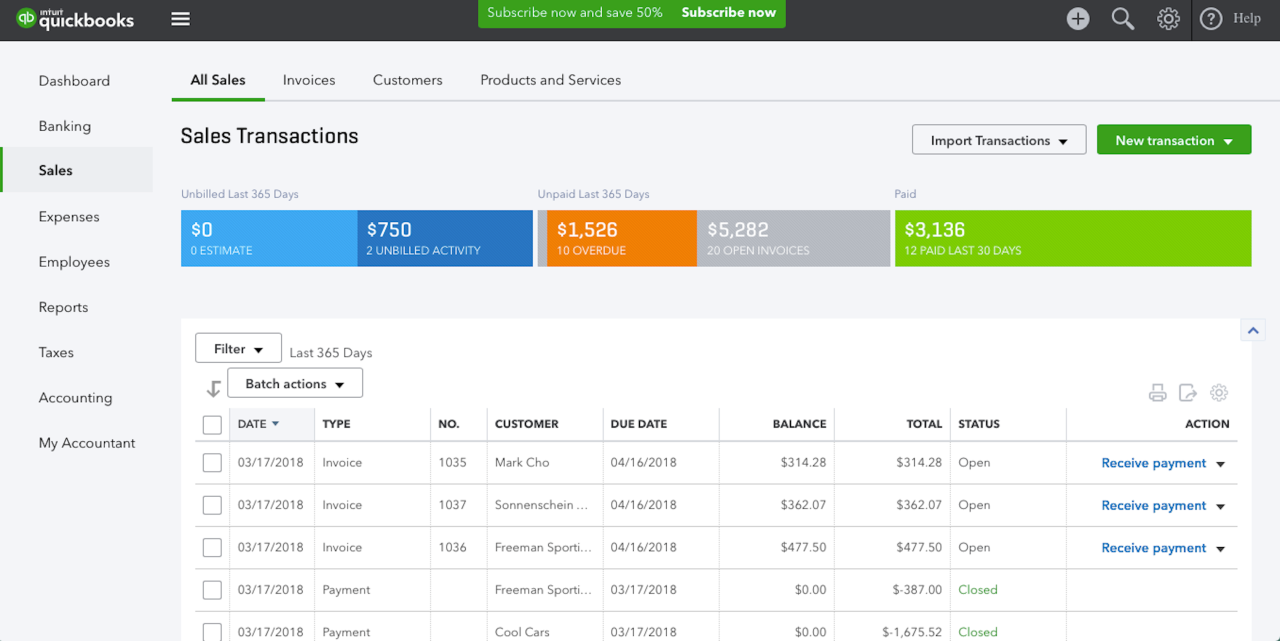

QuickBooks Online (QBO) is a cloud-based accounting software designed for small businesses and freelancers. It offers various plans with different features and pricing options to cater to diverse needs and budgets. Understanding the pricing structure of QBO is crucial for businesses to make informed decisions about their accounting software investment.

This blog post will delve into the details of QuickBooks Online pricing, including the different plans available, their respective features, and the factors to consider when selecting the right plan. We will also discuss additional costs associated with QBO, such as add-ons and support fees.

Whether you’re a seasoned business owner or just starting out, this guide will provide you with the information you need to navigate the QuickBooks Online pricing landscape and find the best plan for your business.

QuickBooks Online Plans and Pricing

>

QuickBooks Online offers three primary plans: Simple Start, Essentials, and Plus. Each plan is tailored to specific business needs and comes with a different set of features and pricing.

The Simple Start plan is the most basic and affordable option, suitable for businesses with simple accounting requirements. The Essentials plan offers more advanced features, including inventory tracking and project profitability tracking, making it ideal for businesses with growing needs.

The Plus plan is the most comprehensive plan, designed for businesses with complex accounting needs, such as multiple users, advanced reporting, and inventory management capabilities.

Factors to Consider When Choosing a Plan

>

When selecting a QuickBooks Online plan, it’s essential to consider several factors to ensure you choose the one that best aligns with your business requirements and budget.

The number of users who will access the software is a key consideration. Each plan has a limit on the number of users allowed, so if you anticipate multiple users, you’ll need to choose a plan that accommodates your needs.

The features included in each plan play a significant role. Evaluate your business’s specific accounting needs and identify the features that are essential for your operations. This will help you determine which plan offers the right combination of features for your business.

Your budget is another important factor to consider. QuickBooks Online plans vary in price, so it’s crucial to assess your financial situation and choose a plan that fits your budget without compromising on the necessary features.

Additional Costs Associated with QuickBooks Online

>

In addition to the monthly subscription fees, there are a few additional costs associated with QuickBooks Online that businesses should be aware of.

Add-ons are optional features that can be purchased to enhance the functionality of your QBO account. These add-ons can come with additional charges, so it’s important to carefully consider the value they provide and whether they are necessary for your business.

Support fees may apply if you require additional assistance from QuickBooks Online’s support team. These fees can vary depending on the level of support needed and the method of communication (phone, email, or chat).

Benefits of QuickBooks Online

QuickBooks Online offers numerous benefits to businesses, including:

- Simplified accounting: QBO automates many accounting tasks, saving businesses time and effort.

- Improved accuracy: QBO’s automated features reduce errors and improve the accuracy of financial data.

- Enhanced productivity: QBO helps businesses streamline their accounting processes, freeing up time for other tasks.

- Cloud accessibility: QBO is accessible from anywhere with an internet connection, allowing businesses to manage their finances on the go.

- Strong security: QBO employs robust security measures to protect sensitive financial data.

These benefits can significantly enhance the efficiency and effectiveness of a business’s accounting operations.

Alternatives to QuickBooks Online

While QuickBooks Online is a popular choice for accounting software, there are several alternatives available.

- Xero: Xero is a cloud-based accounting software that offers a range of plans and features comparable to QuickBooks Online.

- Sage Accounting: Sage Accounting is another cloud-based accounting solution that provides comprehensive features, including inventory management and project tracking.

- FreshBooks: FreshBooks is a simple and user-friendly accounting software designed for small businesses and freelancers.

- Wave: Wave is a free and open-source accounting software that offers basic features for small businesses.

- Zoho Books: Zoho Books is a cloud-based accounting software that offers a wide range of features, including CRM and project management.

These alternatives may offer different pricing models, features, and integrations, so it’s important to carefully evaluate each solution to determine the best fit for your business.

Choosing the Right QuickBooks Online Plan

To choose the right QuickBooks Online plan, businesses should consider the following steps:

- Identify your business’s accounting needs:

- Evaluate the different plans: Compare the features, pricing, and limitations of each plan to find the one that aligns with your needs.

- Consider scalability: If your business is likely to grow or evolve in the future, choose a plan that allows for scalability and additional features.

- Get professional advice: If necessary, consult with an accountant or financial advisor to assist you in making an informed decision.

By following these steps, businesses can select the QuickBooks Online plan that best meets their current and future accounting requirements.

Living Happy

Living Happy